2021’s Lows On The Horizon For The EUR/USD

The Greenback has opened July with a bang, especially versus the Euro. Through the first week of trade, the EUR/USD is off 51 pips (-0.41%). The sudden strength from the dollar has come on the heels of more hawkish Fed talk, the spread of the Delta variant, and expectations from the forthcoming late-month FOMC Meeting.

On the economic news front, it has been a relatively quiet Tuesday session. This morning’s key release was the Markit Composite PMI (June), which came in at 63.7. This figure lagged May’s 68.7 and consensus projections of 63.9. However, the figure suggests only a short-term economic slowdown in relation to growing cost pressures.

Every now and then, it’s a good idea to check in with the CME FedWatch Index. Currently, the index is projecting a 100% chance of interest rates staying at 0.0-0.25% until March 2022. At that point, the index is assigning a modest 7.6% probability of a ¼ point rate hike. With 22 days to go until July’s Fed meeting, it looks like rates are to be held at 0% until the fall of 2022. Of course, these numbers can and will change.

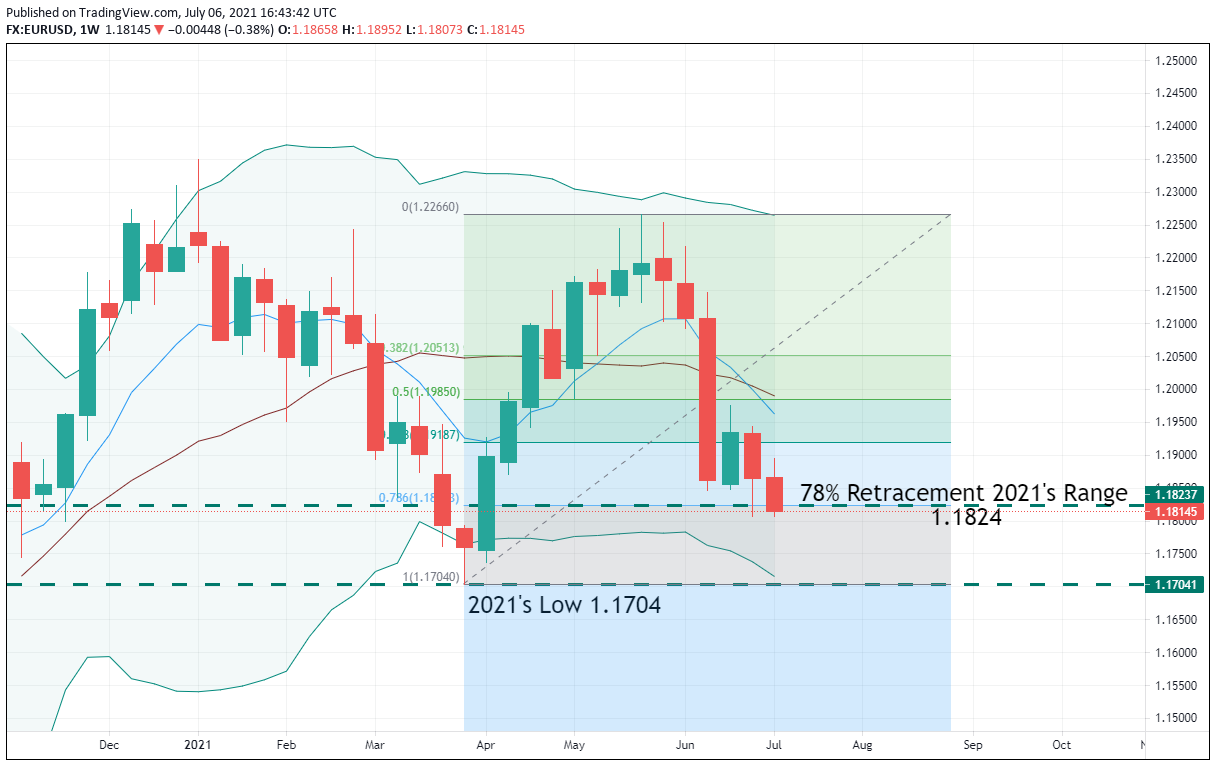

For the EUR/USD, yearly lows are quickly coming into view. Let’s dig into the weekly technicals and see if we can spot a trade or two.

EUR/USD Drives Toward Yearly Lows

At press time, the EUR/USD is testing the 78% retracement of 2021’s range at 1.1824. If this level fails, then a run at 1.1700 is highly likely.

Bottom Line: For the time being, a bearish bias is warranted toward the EUR/USD. If rates continue to fall, then a long trade entry from 2021’s low may come into play. Until elected, I’ll have buy orders in the queue from 1.1714. With an initial stop loss at 1.1669, this trade produces 45 pips on a standard 1:1 risk vs reward ratio.