Cryptocurrencies Weekly Summary (Aug 09-14) – Top Five Crypto Coins to Watch

- Bitcoin reacted to the downside below the $45,000 support zone and bounced off above $46,000.

- US producer prices posted their highest annual increase in more than a decade in the 12 months through July.

- Ripple Labs Inc. has recently made a few significant deals, despite being burdened by the Securities and Exchange Commission (SEC) lawsuit.

Bitcoin (BTC/USD) Weekly Review

The BTC/USD failed to maintain its previous bullish bias, dropping from the $46,700 resistance level to below $45,000. Bitcoin is now correcting gains, and it might drop close to the $42,850 support zone.

The BTC price failed to continue higher, above the $46,500 and $46,700 resistance levels. As a result, BTC reacted to the downside, below the $45,000 support zone. The declines appeared, even after Argentina’s President Alberto Fernandez showed his support for digital assets. However, the following primary resistance is now forming near the $45,500 zone.

A clear break above the $45,250 and $45,500 resistance levels could push the BTC prices up. Conversely, if bitcoin fails to climb above the $45,250 and $45,500 resistance levels, it could face further losses. Immediate support on the lower side is near the $44,500 level. The BTC/USD is trading near the $45,012.3 level, with a 24-hour trading volume of $25,845,187,436.

The prevalent selling bias surrounding Bitcoin could be tied to the strength of the broad-based US dollar. The greenback managed to keep itself strong on Friday, remaining close to its highest level in four months against a basket of other currencies, as investors sought more hints from the Federal Reserve on its plans to reduce monetary stimulus.

The US dollar was supported by economic data released on Thursday, showing that US producer prices posted their highest annual increase in more than a decade in the 12 months through July. The upticks in the US dollar were understood as one of the key factors that kept the BTC/USD subdued.

On the other side, President Alberto Fernandez of Argentina has indicated support for digital assets, saying there is no cause to drive back against the emerging asset class. During a discussion with the local media outlet, Fernandez was asked whether he would consider exploring a central bank digital currency (CBDC) or even recognize Bitcoin as legal tender, as El Salvador did earlier this year. Fernando replied: “I don’t want to go too far out on a limb, but there is no reason to say ‘no’. They say the advantage is that the inflationary effect is largely nullified.”

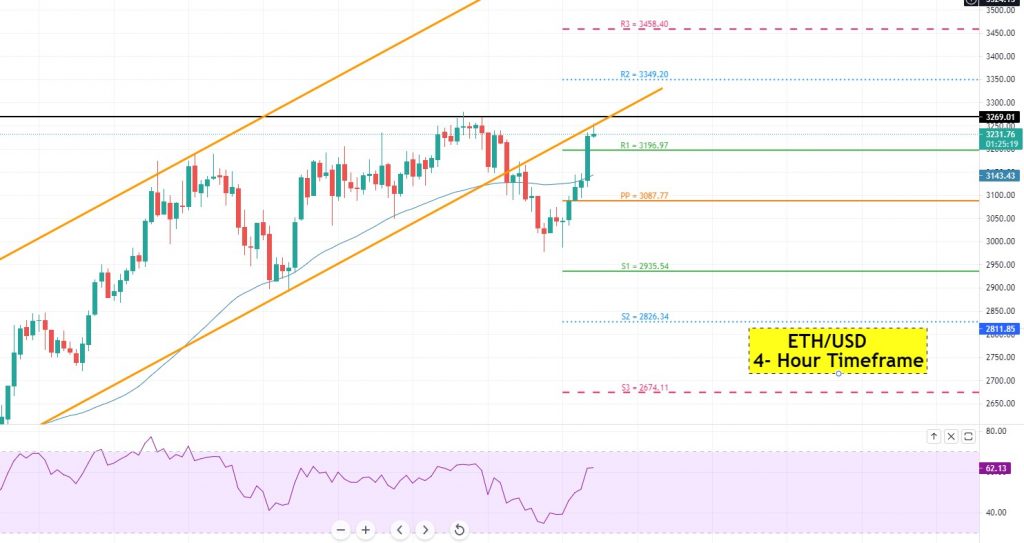

Ethereum (ETH/USD) Weekly Review

The ETH/USD also failed to extend its previous gains, falling from the $3,200 resistance zone to $3,035. Ethereum was unable to hold its gains above the $3,200 resistance zone against the US dollar.

The ETH/USD price remains on the subdued track, and it might continue to drop to below the $3,000 resistance. Yesterday, the prices of ETH climbed higher, well above the $3,150 resistance zone. It even broke the $3,200 resistance zone, settling nicely above the 100-hourly simple moving average.

The gains were short-lived, as the strong broad-based US dollar kept a lid on any additional gains in the ETH/USD. A clear break above the $3,250 and $3,275 resistance levels might trigger some upside progress. The next key resistance might be near the $3,350 level, above which the price might rise towards the $3,500 resistance zone.

If ETH fails to stop its losses and does not refresh higher, above the $3,250 and $3,275 resistance levels, it could face a massive downside correction. The next support on the lower side is near the $3,000 level. However, the ongoing bearish bias in the Ethereum prices could be attributed to the upticks in the US dollar. The US dollar remained around a four-month high, as investors await more hints from the US Federal Reserve regarding a timetable for asset tapering and interest rate hikes.

Meanwhile, the previously released US data, which showed that US producer prices posted their highest annual surge in more than a decade in the 12 months through July, added a further boost to the sentiment surrounding the US dollar. Therefore, the upticks in the US dollar were understood as one of the key factors that kept the ETH/USD subdued.

Litecoin (LTC/USD) Weekly Review

The LTC/USD crypto pair managed to stop its overnight downward rally and drew some sharp bids above the $175.00 level yesterday. The LTC/USD is currently trading around $175.495, with a 24-hour trading volume of $1,990,117,717. Litecoin has risen by 2.95% in the last twenty-four hours.

It is worth recalling that the LTC/USD faced a 3.21% price drop on the previous day of trading, but now it looks like it might head towards the $180 level. On the bearish side, the first support level could lie at $150, but this is expected to stop the market from falling further. Meanwhile, if the bearish bias picks up pace, traders can expect added support at $140, $130 and $120. In contrast to this, the nearest resistance levels could be located at $170 and $180. Above this, potential resistance lies at $200, $210 and $220.

Meanwhile, the upticks in the LTC coin could be also attributed to the reports suggesting that the biggest provider of cryptocurrency payment services announced last week that they would be supporting Litecoin in their BitPay wallet.

As per critical remarks, the “Bitpay Wallet app supports 12 cryptocurrencies and stable coins: BTC, BCH, DOGE, ETH, LTC, WBTC, XRP, BUSD, DAI, GUSD, PAX and USDC”. The cryptocurrency payment provider, Bitpay has modernized its wallet app, introducing Google Pay, with which US cardholders can pay their cryptocurrencies. The company previously included Apple Pay, and Samsung Pay is anticipated to follow shortly. Thus, these optimistic headlines tend to exert a positive influence on the LTC/USD pair.

On the other hand, the strong US dollar was one of the critical factors that limited its gains. The broad-based greenback extended its gaining rally of the previous session, remaining close to a four-month high, as investors awaited more hints from the US Federal Reserve as to when asset tapering and interest rate hikes will begin. Meanwhile, the previously released positive US data boosted the prices of the American currency. Thus, the upticks in the US dollar were seen as a key factor that capped further gains in the LTC prices.

Ripple (XRP/USD) Weekly Review

The XRP/USD crypto coin extended its upward rally of early in the day, remaining well bid around the 1.03187 level. Ripple’s XRP, which recorded 14.3% in gains over the last 48-hours and, with a 63.6% price increase, was seen as one of the major performers of the month.

Despite being burdened by the Securities and Exchange Commission (SEC) lawsuit (claiming that Ripple Labs Inc. had violated investor-protection laws by selling XRP as unregistered security), the company has recently made a few significant deals.

Specifically, GME Remittance, one of the biggest non-bank remittance service providers in South Korea, announced yesterday that it had joined Ripple’s payment network, RippleNet.

In addition to this, Japan’s money-transfer provider, SBI Remit, teamed up with the mobile payments service, Coins.ph, and the digital asset exchange platform, SBI VC Trade. They did it in order to transfer remittance payments from Japan to the Philippines via Ripple’s on-demand liquidity (ODL) service. So, that is what’s behind its bullish rally.

As we have already mentioned, Ripple announced that GME Remittance, one of the biggest non-bank remittance service providers in South Korea, had joined RippleNet. This news boosted the Ripple prices, with the crypto climbing past the $1 mark over the last 24-hour period. RippleNet offers “connections to hundreds of financial institutions globally, through a single API, and makes moving money faster, cheaper and more secure.”

Dogecoin (DOGE/USD) Weekly Review

The DOGE/USD has failed to maintain its previous bullish bias, turning sour on the day, as Bitcoin declined towards the $45,000 level. The world’s leading cryptocurrency failed to settle above the resistance at $46,000, and moved towards $45,000. The bearish bias in the world’s leading cryptocurrency has impacted other cryptocurrencies, including Dogecoin, negatively.

Apart from this, the bullish bias in the US dollar was also seen as another factor that kept the DOGE/USD lower. The Dogecoin is trading near $0.261208, with a 24-hour trading volume of $3,887,226,853. Dogecoin has dropped by 1.25% in the last 24 hours. The bullish greenback is trying to undermine the DOGE/USD coin. The broad-based American currency maintained its upward rally of early in the day, remaining well bid on the day, as investors looked for more hints from the Federal Reserve on its plans to reduce monetary stimulus.

In the meantime, the risk-off market sentiment pushed traders towards the safe-haven assets, boosting the US dollar prices. Thus, the upticks in the greenback have become the key factor that is keeping the DOGE/USD down.