Buying the Retreat in EUR/CHF As High Inflation Keeps the ECB Hawkish

Both the Euro and the Swiss Franc were extremely weak this year against the USD as the FED kept a very fast pace of rate hikes, particularly the Euro, which sent this pair to 0.9420 in late September. But the sentiment has improved since then and risk assets have been gaining some momentum, with EUR/USD climbing nearly 10 cents from the bottom below parity.

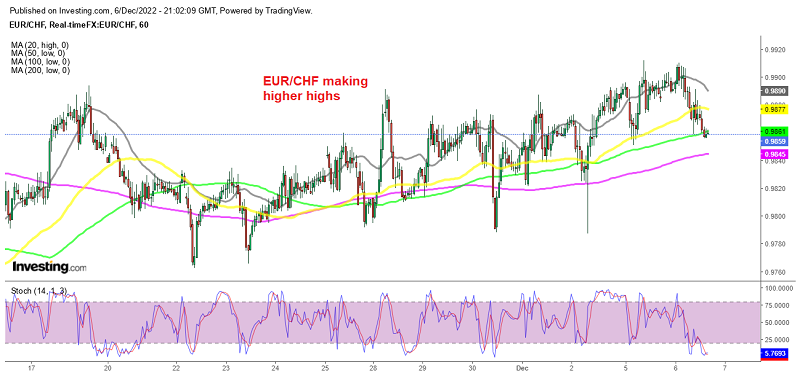

EUR/CHF has also turned bullish since then, and increased to 0.9960 by the middle of October. In early November we saw a retreat lower, although the 100 SMA turned into support on the daily chart and this pair bounced off that moving average.

The trend has been bullish since then, although the pace has been slow. We have seen retraces higher which have been held by moving averages and then buyers have come in and resumed the bullish momentum. We decided to open a buy EUR/CHF signal yesterday right at the 100 SMA (green) on the H1 chart after the 50 pip retrace lower, with the stochastic indicator being oversold on this timeframe chart.

Swiss consumer inflation CPI stands at around 3%, as November’s inflation report confirmed. Despite inflation exceeding the Swiss National Bank’s target the SNB won’t be too aggressive and will probably stop rate hikes soon. The ECB started a bit late, so they might continue for some time, which will be a bullish factor for this pair.