The Day After Thanksgiving – What’s Going On In The Forex Market?

Good Morning, fellas. It's such a lovely cool morning here. After a long weekend, we are finally able to get back to trading. Looking generally at the forex charts, it seems like things haven't changed a lot. So far, the Asian session is lacking trading volume since it's just a normal Monday with no exciting news during the holidays.

For a better sense of which signals we are looking at this week, check out the Nov. 27 – Forex Signals Brief by my colleague Rowan.

Top Economic Events Today

Great Britain Pound – GBP

MPC Member Haldane Speaks – At 14:30 (GMT) today, Haldane, MPC (Monetary Policy Committee) member, is expected to speak about the Bank of England's education and communication strategy, in Birmingham. This news is not expected to cause any fluctuations in the forex pairs.

U.S. Dollar – USD

New Home Sales – At 15:00 (GMT), the Census Bureau will be releasing data on new home sales. This is the annualized number of new single-family homes that were sold during the previous month.

The influence of these numbers is pretty logical; the greater number of homes sold, the greater people's confidence in the economy, the more job security and growth. However, this figure is expected to drop this month from 667K to 627K. This could weigh on the dollar today.

FOMC Member Kashkari Speaks – Later at 22:30 (GMT), the Federal Reserve Bank of Minneapolis President Neel Kashkari will be speaking at Winona State University's Town Hall Forum, in Minnesota. Since audience questions are expected, we can expect some volatility because of his remarks. Let's keep an eye on it.

Top Trade Setups To Watch Today

EUR/USD – Oversold Pair

Looking at the Euro chart, it continues to trade bullish against the dollar. At the moment, the EURUSD is facing a resistance at $1.1930. Doji candles on the 4 – hour chart just below $1.1930 are signifying the potential of reversal.

EURUSD – 4- Hour Chart – Doji Candles

EURUSD – 4- Hour Chart – Doji Candles

However, the daily chart is showing something opposite. We can see a "Three White Soldiers" which is supporting the bullish trend. This week, the EURUSD is likely to target $1.20400 and on a lower side, this can go to $1.1845.

EUR/USD – Key Trading Levels

Support Resistance

1.1776 1.2008

1.1628 1.2092

1.1544 1.224

Key Trading Level: 1.186

EUR/USD Trading Plan

Due to a lack of major fundamentals, we can expect EUR/USD to trade in a range of $1.1900 – $1.1945. The breakout in the range will determine further trends today.

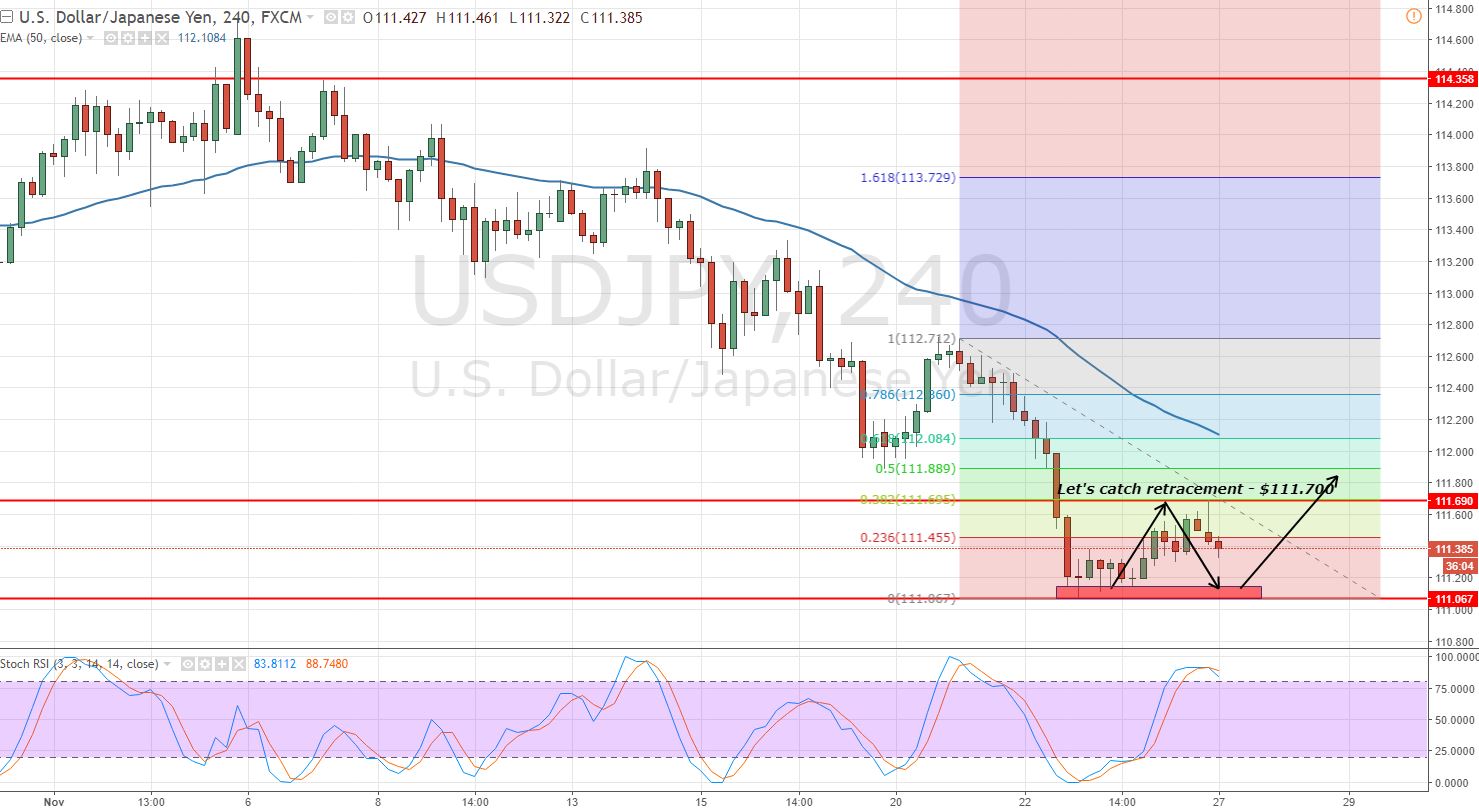

USD/JPY – Retracement Completed

As mentioned in our previous update Thanksgiving Holiday – Forex Market At A Standstill, the USD/JPY hit our suggested target level of $111.700 and pulled back right after testing it.

USDJPY – 4 – Hour Chart – Range

USDJPY – 4 – Hour Chart – Range

At the moment, it's trading in the range of $111 – $111.700. Looking at the USD/JPY 4 – hour chart, the RSI and Stochastics are holding in the overbought zone. The 50- periods EMA has left the CMP behind, which signals that bulls may enter the market to buy a cheaper currency pair.

USD/JPY – Key Trading Levels

Support Resistance

110.8 112.45

110.1 113.4

109.15 114.1

Key Trading Level: 111.75

USD/JPY Trading Plan

The idea is to enjoy the choppy trading session by selling at top $111.700 and buying at low $111 until we have a fundamental reason to define a direction. Good luck and have a profitable week!

EURUSD – 4- Hour Chart – Doji Candles

EURUSD – 4- Hour Chart – Doji Candles  USDJPY – 4 – Hour Chart – Range

USDJPY – 4 – Hour Chart – Range