US Session Forex Brief November 28 – Sentiment Turns Positive Ahead of the G20 Summit, But Markets Remain Cautious

The G20 Summit is approaching and financial markets seem to be adjusting themselves ahead of that meeting. There are certain events which might increase the risk in the days to come, but for now, markets are on a slight risk-on mode. Stock markets are a bit higher today, USD/JPY has been totally bullish this week, while Gold has turned bearish today.

The risks are the G20 meeting as we mentioned, the US tariffs on cars which exclude only Mexican and Canadian produced motor vehicles and the FED Chairman Powell’s speech later this afternoon. The US car tariffs were expected to come in spring next year but they might be applied as soon as next week.

On other news during the European session, the EU sounded worried about the global economic growth. With Brexit ongoing, the Italian deficit issue still not being resolved completely and especially now that car tariffs are coming, the EU is right to worry about the economic growth and this might even be a signal for the European Central Bank to keep the monetary policy loose until things improve.

Speaking of Brexit, the UK Government will allow the UK Parliament to amend the Brexit draft that May and the EU reached last week. But, will the EU accept a revised draft? That’s another worry for the markets now.

The European Session

- Italian Deficit Is Expected Close to 2.0% – A report from La Repubblica this morning suggested that a cut of 0.2% from the 2.4% planned deficit for next year’s budget is not enough for Italy. The deficit should be closer to 2.0% and Italian Deputy Prime Ministers, Di Maio and Salvini, are still negotiating with the EU on that.

- German GfK December Consumer Confidence – The GfK consumer confidence in Germany was expected at 105 points today, but it came at 104 points. This indicator is turning bearish now and it declined two points from last month which stood at 106 points.

- Saudis Expect A Stable Oil Market Next Year – Oil Minister of Saudi Arabia commented earlier today that he expects the Oil market to be stable in 2019. But, that’s what they usually say every year, don’t they? Well, we will see. Meanwhile, Oil prices have lost nearly a third of the value from the highs earlier this year.

- Italian Politicians Still Trying to Bargain – Italian Deputy PM Di Maio said a while ago that the government cannot betray promises to its citizens and still wants dialogue with the European Commission. Finance Minister Giovanni Tria backed Di Maio up saying that Italy wants a solution without dramatization.

- EU Worried About Global Economy – The European Union commented this morning that the global economic expansion is increasingly under threat. This might be a signal for the ECB to keep interest rates low for longer.

- Donald Trump Pushing for the Wall –A report suggested today that US President Trump is willing to allow a government shutdown on the border wall issue if the Congress doesn’t pass the $5 billion bill to fund the building of the wall between the US and Mexico border. December 7 is the key deadline.

- UK Government Points to a 2.1%-3.9% GDP Reduction from Brexit Deal – The UK Government released its analysis of the Brexit scenarios and points that the GDP might be reduced by 2.1%-3.9% in the next 15 years on this Brexit deal. The impact would have been smaller if the EU accepted the Chequers deal or if the UK stayed in the EEA, but it is much better than a no-deal scenario which would reduce the GDP by 7.7%.

- China Will Open Up More – The Chinese President Xi Jinping is in Madrid where he said that China’s door will be wide open for international investors. He also added that China will set up protection for intellectual property theft. This is a new one. They hope Donald Trump is listening.

The US Session

- US MBA Mortgage Applications – US mortgage applications grew by 5.5% as shown in today’s report after they declined by 0.1% previously. All the components such as the purchase index, the market index and the refinancing index also came out higher.

- US GDP Report – The US GDP for Q3 remained unchanged on the second estimate at 3.5% as previous. It was expected at 3.6% but it’s not much of a change. The GDP price index also remained unchanged at 1.7% for Q3.

- US Trade Balance Report – The US trade deficit increased to -$77.2 billion against -$76.7 billion expected. The trend here looks pretty bad since the trade deficit has been constantly increasing and I bet that Donald Trump hates these numbers.

- US New Home Sales – The report for the new home sales in the US will be released in about an hour. Last month, new home sales were expected to come at 627k but came at 553k which was disappointing, but today they are expected to increase to 583k.

- BOE Governor Carney Speaks – The Governor of the Bank of England Mark Carney will hold a press conference later today after the BOE releases the bank stress test results and the financial stability report.

- FED Chairman Powell Speaks – The FED Chairman will also speak later in the afternoon today. It will be interesting to hear him because rumors for the FED to stop hiking interest rates next year have been increasing.

Trades in Sight

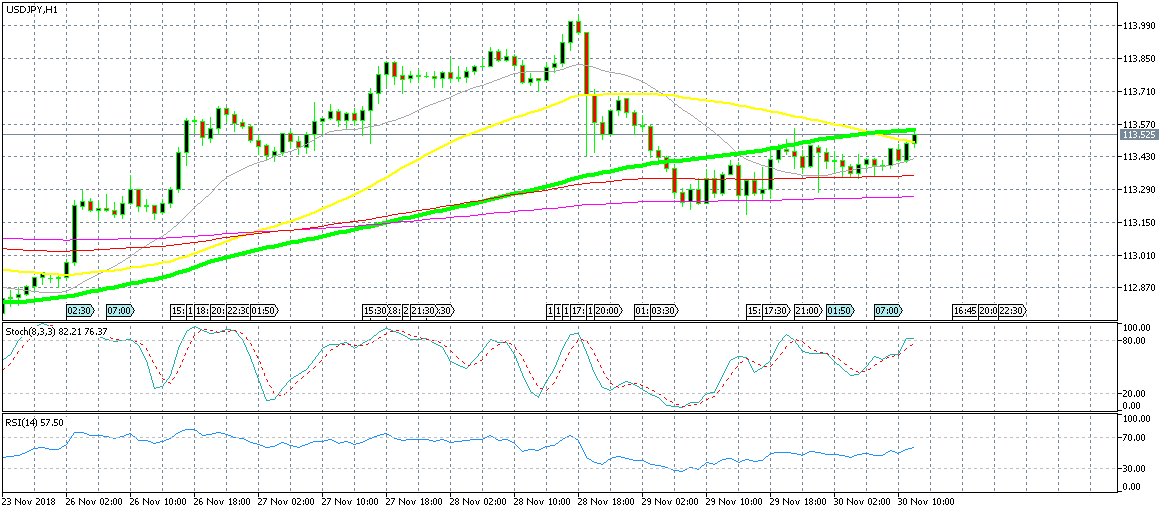

Bearish USD/JPY

- The Trend is bullish

- Sentiment is slightly positive

- The pullback lower is complete

The stochastic indicator is almost overbought

We went long on USD/JPY earlier today. This pair has been on a strong uptrend this week which picked up pace yesterday. Although, USD/JPY retraced lower during the Asian session but that retrace was complete a few hours ago. The stochastic indicator became oversold on the H1 chart and the candlestick formed a pin which is a reversing signal. Besides, the sentiment in financial markets leans slightly on the positive side which should support this pair.

In Conclusion

Markets have been pretty quiet during the European session today, but the volatility will probably pick up later in the afternoon when FED’s Jerome Powell comes to speak. The BOE Chair Carney is also speaking, so we’re likely to have some decent price action in major forex pairs this afternoon.