UK Mortgages Increase, But Consumer Spending Declines

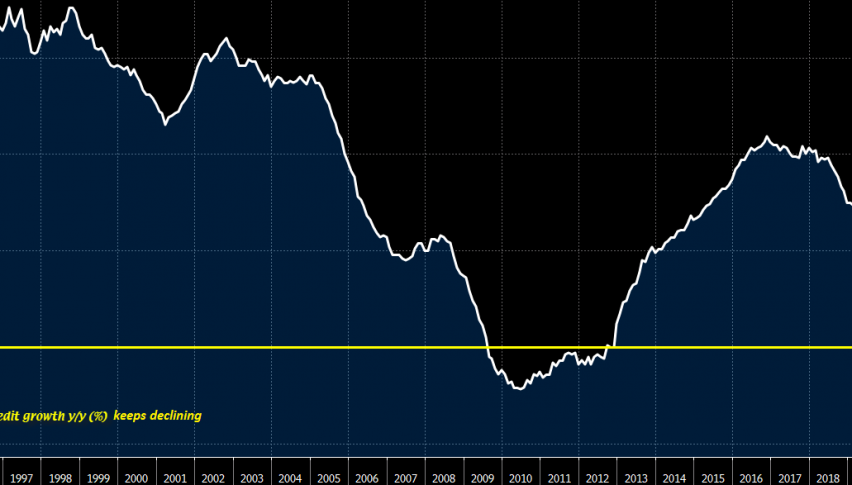

The mortgage market was in a good condition in US last year, being in the 60k region, while in the first two months of this year, mortgages increased to 70k. But, they dived during the lock-down months, although they are coming back as the economy restarts. But, the consumer credit is declining fast. This shows that banks and other lenders are not confident giving credit to consumers, which will dent the economic recovery in the coming months if it continues.

Latest data released by the BOE – 29 July 2020

- June mortgage approvals 40.0k vs 35.0k expected

- May mortgage approvals 9.3k

- June net consumer credit -£0.1 billion vs -£2.0 billion expected

- May mortgage approvals -£4.6 billion; revised to -£4.5 billion

Mortgage approvals rebounded in June, following the low figures posted in April and May. But that sort of belies the underlying conditions that the credit data are suggesting from the report. Consumer credit growth slumped further from -3.0% YoY in May to -3.6% YoY in June and that to me remains the standout data point. Granted that the struggle in consumer credit already began before the virus crisis, this pretty much just exacerbates that.