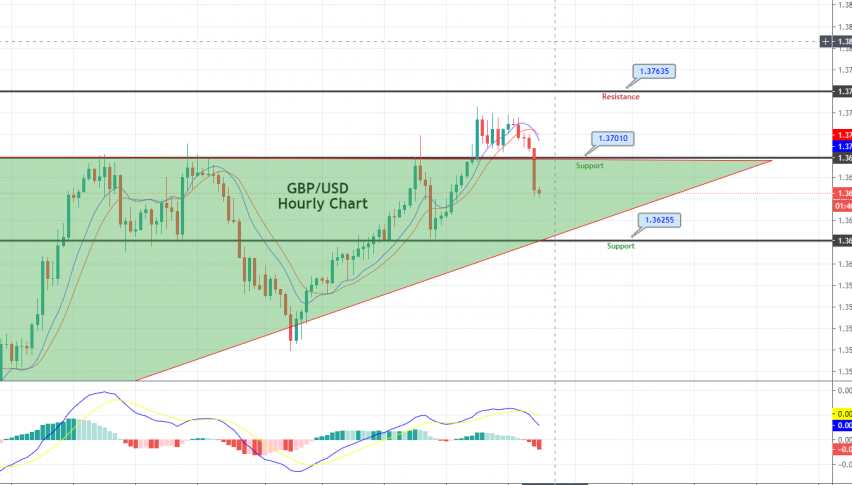

The GBP/USD pair fell sharply, below the 1.3710 support level, and it seems to be going after the support area of 1.3625. The Sterling seems to be getting weaker, as the retail sales volumes grew by 0.3% compared with November 2020, ending in an expansion of 2.7% compared with February’s pre-lockdown level.

The US Dollar Index (DXY), which measures the value of the greenback against a basket of six currencies, fell by 0.2% on Thursday, to 90.04, which is its lowest level since January 13. This weakness in the US dollar helped the GBP/USD currency pair to rise, despite the better-than-expected economic data from the US.

On the data front, at 16:00 GMT, the CBI Industrial Order Expectations were released, indicating a drop to -38 in January, against the expectations of -35, which weighed on the British Pound, limiting the upward momentum of the GBP/USD pair. From the US side, at 18:30 GMT, the Philly Fed Manufacturing Index for January came in, showing a surge to 26.5, against the projected 11.2, which suported the US dollar. Last week, the Unemployment Claims dropped to 900K, from the projected 930K, boosting the US dollar and capping any further gains in the GBP/USD pair. The Building Permits for December surged to 1.71M, against the projected 1.60M, lending support to the greenback. The Housing Starts for December also surged, coming in at 1.67M, against the projected 1.56M, which supported the US dollar, but failed to reverse the upward momentum of the GBP/USD currency pair.

Furthermore, Sterling investors remained hopeful, as the rollout of coronavirus vaccines in the UK almost hit the expert’s prediction of 350,000 doses a day. On Wednesday, over 343,000 doses were administered to the most vulnerable members of the UK population. Investors were also optimistic that the lockdown restrictions would be eased in mid-February, as initially announced by the government.

Another reason behind the strength of the British Pound is the latest announcement by the Secretary of State for Education, Gavin Williamson, who said that he hoped schools would be able to reopen before Easter, which is a far cry from February. However, Prime Minister Boris Johnson said it was too early to tell when the restrictions would be lifted, as the UK was still battling the contagiousness of the new variant of the virus that emerged just before Christmas. He added that there was no doubt that the new variant spreads very fast.

Support Resistance

1.3622 1.3717

1.3576 1.3764

1.3528 1.3811

Pivot Point: 1.3670

The GBP/USD is trading at the 1.3661 level, and it’s likely to face resistance at 1.3701. On the downside, the GBP/USD pair may find support at the 1.3625 level. The 10 & 20 Periods EMAs are supporting a selling trend in the pair. The idea is to do bearish trades below the 1.3700 level, targeting 1.3625. Good luck!