The GBP/USD currency pair closed at 1.39728, after placing a high of 1.39856, and a low of 1.38394. The GBP/USD pair rose, posting massive gains and reaching its highest level in three years on Thursday. The strength of the British Pound against the US dollar is likely to continue in the short-term, however it could reverse its direction after the impact of Brexit begins to make its mark. The sharp rise in the British Pound on Thursday was a result of Prime Minister Boris Johnson’s recent statement that the lockdown restrictions would be lifted in stages. The PM appeared eager to suppress growing optimism over a faster reopening, as he insisted that further data was required, in order to determine the extent to which vaccines can reduce the transmission rates.

Further data from the vaccination campaign in the UK will be released on Friday; however, it is unclear whether this data will give any indication of whether the vaccine is reducing the spread of infections. Meanwhile, hopes for a quick recovery after the successful vaccination campaign in the UK boosted the British Pound, which ultimately supported the GBP/USD pair.

However, the trend is likely to turn again once signs of the impact of Brexit start to show. It may take a considerable time before the impact of Brexit becomes clearer and distinct from the impact of the coronavirus, as the corona-related lockdowns have disrupted economic activities.

Meanwhile, Bank of England policymaker Michael Saunders said on Thursday that he would focus on Britain’s labor market in the coming months, as it is expected to remain weak, even once the pandemic is over. Saunders said that the economy might still have spare capacities once the economy has returned to its pre-crisis level. These comments also helped the British Pound and supported the upward trend in the

GBP/USD pair.

On the flip-side, the US dollar remained weak on Thursday due to falling US Treasury yields, and the disappointing US jobless claims figures from last week.

On the data front, at 18:29 GMT, the Philly Fed Manufacturing Index for February came in, showing an increase to 23.1, against the anticipated 20.3, which supported the US dollar and capped any further gains in the

GBP/USD pair. At 18:30 GMT, the Building Permits for January were released. They indicated a rise to 1.88M, against the anticipated 1.67M, which boosted the greenback and limited the upside momentum for the

GBP/USD pair.

In January, the Housing Starts fell to 1.58M, against the anticipated 1.66m, weighing on the US dollar and supporting the rising prices of the

GBP/USD pair. In January, the Import Prices increased to 1.4%, against the anticipated 1.0%, which supported the US dollar. The Unemployment Claims from last week increased to 861K, against the anticipated 775K, weighing on the US dollar, and adding further to the gains in the

GBP/USD pair.

Furthermore, the US dollar was also under pressure, due to the minutes of the Federal Reserve Monetary Policy meeting for January, which revealed that the Fed was happy with the loose monetary policy and had no plans of changing it in the near future. This weighed on the greenback and further boosted the rising prices of the

GBP/USD pair on Thursday.

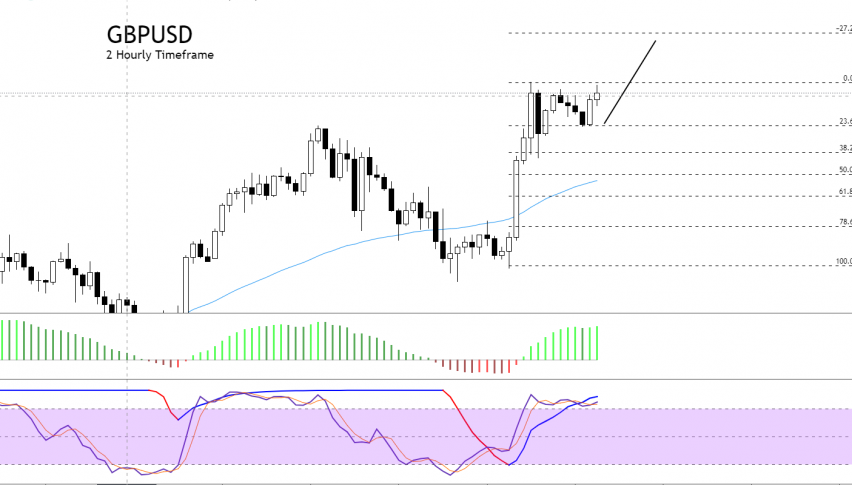

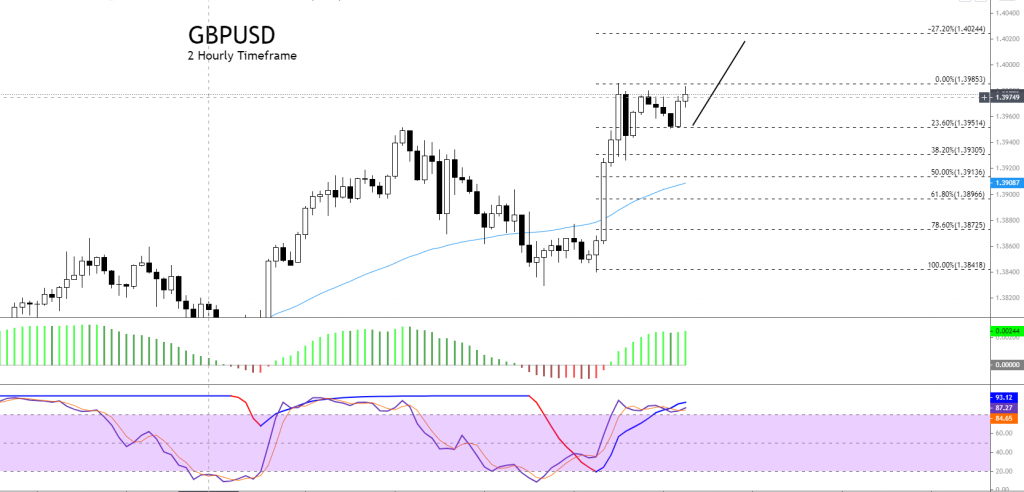

Daily Technical Levels

Support Resistance

1.3818 1.3901

1.3782 1.3948

1.3735 1.3984

Pivot Point: 1.3865

The GBP/USD pair is trading at 1.3954, and it is finding immediate support at the 1.3951 level, which is extended by the 23.6% Fibonacci retracement level. Since the pair has entered the overbought zone, we may see a retracement in the GBP/USD pair, until the 1.3930 level, which marks the 38.2% Fibo level. A further bearish breakout could extend the selling trend until the 1.3930 and 1.3913 areas, where the 50 periods EMA is likely to support the Cable. Conversely, a bullish breakout could drive more buying until around 1.4024. Good luck!