⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

USD/CAD Turns Bearish Again, After the Great Employment Report From Canada

USD/CAD has been on a bearish trend for about a year, since WTI crude Oil reversed higher from all time lows in April last year. The CAD has benefited from it, hence the bearish trend in this pair for nearly a year. Since the middle of March though, this pir has retraced higher, climbing around 3 cents as the USD gains some momentum, but today’s employment report from Canada showed some really strong gains for March, so USD/CAD has turned bearish again now.

Canada March Employment Report

- March employment +303.1K vs +100.0K expected

- February employment was +259.2K

- Full time +175.4K vs +88.2K prior

- Part time 127.8K vs +171.0K prior

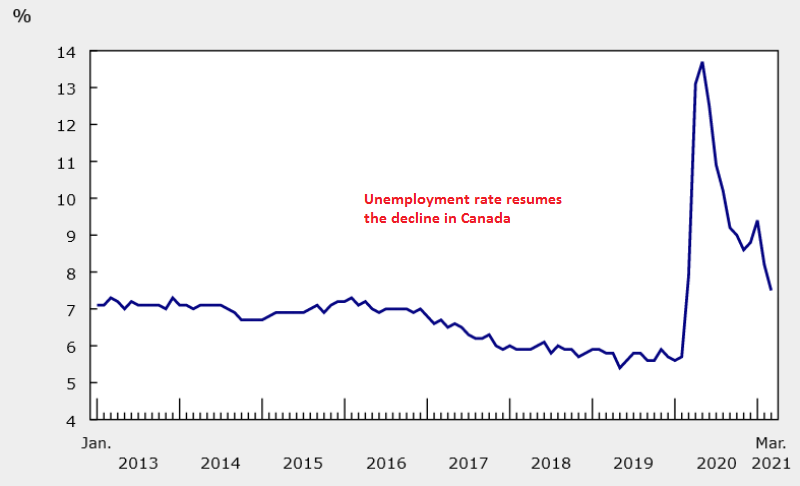

- Unemployment rate 7.5% vs 8.0% expected (8.2% prior)

- Participation rate 65.2% vs 64.7% prior

- Hourly wage rate for permanent employees +2.0% vs 1.9% y/y expected

- Prior wage rate +4.3% y/y

- Total hours worked +2.0% vs +1.4% prior

- Long-term unemployment flat in March

This is a sensational jobs report. As a rule of thumb, you multiply this by 10 to give you a sense of how it would compared to non-farm payrolls. That’s imperfect in a lot of ways because Canadian data is more volatile but it’s undoubtedly an amazing report.

Sadly, much of that progress is going to be erased in April because of strict lockdowns but I think you can look beyond that and conclude that Canada can bounce back quickly once the vaccines really roll out, which is going to be May, June, July. With this report, employment is within 1.5% of its pre-covid level, or just 296K jobs.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments