Booking Profit After Selling Crude Oil, as US Jobless Claims Miss, But Remain Below 400K

Crude oil has been on a bullish trend since April last year, when US WTI crude dived to $-37. The price reversed when the world didn’t come to an end due to coronavirus, and it kept climbing higher without looking back. The rebounding global economy is helping keep the sentiment bullish for oil, as the demand for energy increases.

But, we saw a quick reversal in crude oil on Tuesday, as OPEC+ failed to reach an agreement on increasing production from August onward. That was expected, but oil tumbled from $77 nonetheless, falling below $0.71. That should have been bullish, but it increased the uncertainty, causing oil to tumble, and we sold the retrace higher at the 20 SMA (gray) today.

The 200 SMA rejected crude oil after the retrace higher today

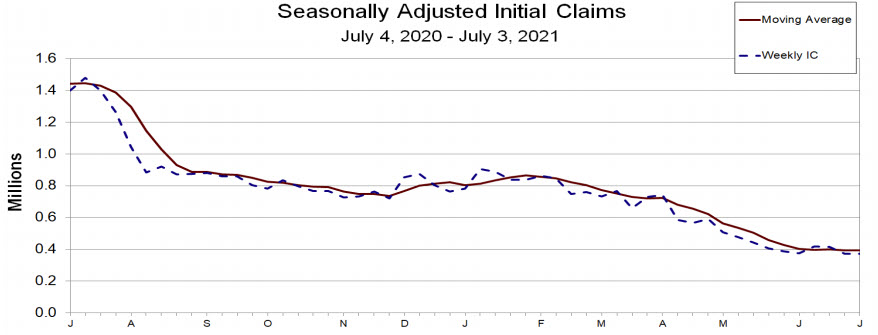

The price has just reversed back down after the US unemployment claims, so we booked 80 pips in profit. Below is the US jobless claims report for last week, which increased compared to the previous report, but still remains below 400K.

Jobless claims for the week ending July 3

- Weekly initial jobless claims 373K vs 350K expected

- Prior week was 364K, revised to 371K

- Four week moving average to 394K from 392K

- Continuing claims 3.339m vs 3.469m prior

- PUA claims 5.824m vs 5.935m prior

- Largest increases in initial claims for the week ending June 26 were in Puerto Rico (+4,098), New Jersey (+3,381), Massachusetts (+2,845), New York (+1,857), and Connecticut (+1,516)

- Largest increases in initial claims for the week ending June 26 were in Puerto Rico (+4,098), New Jersey (+3,381), Massachusetts (+2,845), New York (+1,857) and Connecticut (+1,516)

- Click here for the full report