Risk Markets Up on Lower Inflation, But Cautious on Recession Fears

Stock markets have been bearish for more than a year on tighter central bank policy, with the FED delivering consecutive massive rate hikes, but the risk sentiment is improving as the FED prepares to stop and probably reverse later in the year on softer inflation.

The consumer inflation report CPI showed a 1% slowdown for last month to 5.0%, while the producer inflation PPI report showed a 0.5% decline. The US PPI data revealed that YoY input costs have decreased to 2.7% on a yearly basis, which is encouraging news for future consumer inflation. This, along with weaker initial job claims, has led to a swing back towards lower inflation.

Due to this, US stocks have mostly risen, especially NASDAQ stocks, as investors lean towards a soft landing scenario and lower rates. However, if the US economy heads into a deeper recession due to overly restrictive FED policy, this sentiment could change.

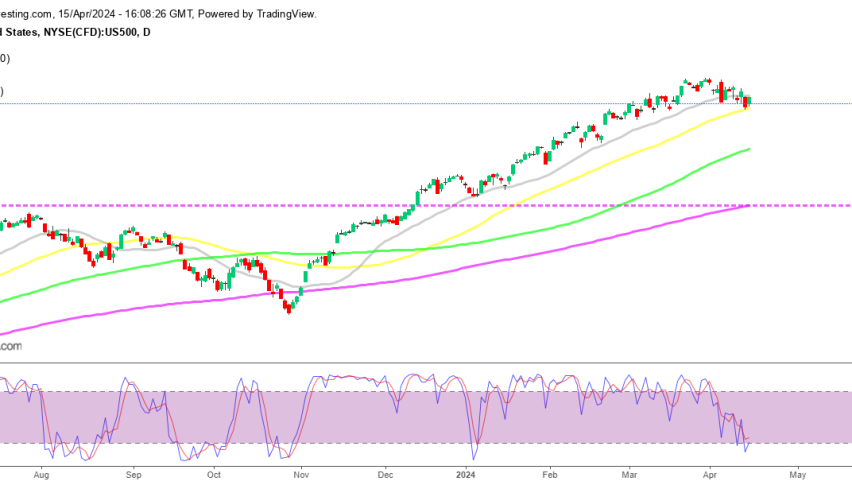

The S&P 500 closed the week bullish on this argument and is heading toward the 100 weekly SMA (green). The US treasury market is also anticipating lower rates from the FED sooner rather than later, with the two-year treasury yields falling below the 4% level at 3.90% and the 10-year yield down 4.4 basis points to 3.38%. Both yields are significantly below the current FED funds target, which has an upper limit of 5% now, down from 5.25% previously.

Although, buyers still seem cautious, with S&P still trading in a range between the 200 SMA (purple) at the bottom and the 100 SMA (green) at the top as traders fear a recession later this year or early in 2024. So, there are two potential scenarios for the economy and the stock market. The first scenario is that the inflated “inflation trade” is over, meaning that it will not rise as much as previously feared and borrowing costs will remain low, leading to a positive environment for stocks.

The other scenario is that the FED will raise interest rates too much and cause a recession, which will negatively impact the stock market. While the second scenario is a possibility, it is not that much of a risk for the stock market. The FED will eventually cut interest rates, which will help the economy and lead to a positive environment for stocks. So overall, we’re leaning more on the bullish side for indices, believing that even in the event of a recession, it will not cause a major downturn. On Friday, US retail sales took a plunge and he USD surged higher, so the fears of a recession are increasing. But for now, it is in the future and it’s still a possibility. Many things can happen until then.