Euro Economy Falters, ECB Rate Cut Odds Up, EURUSD Down

EUR/USD held above 1.11 last week, even amid poor economic data from the Eurozone, but began to slide following today’s weak PMI report.

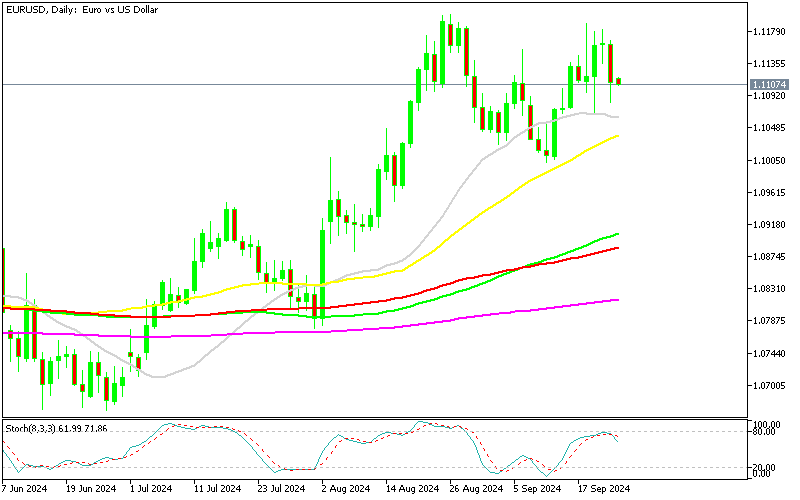

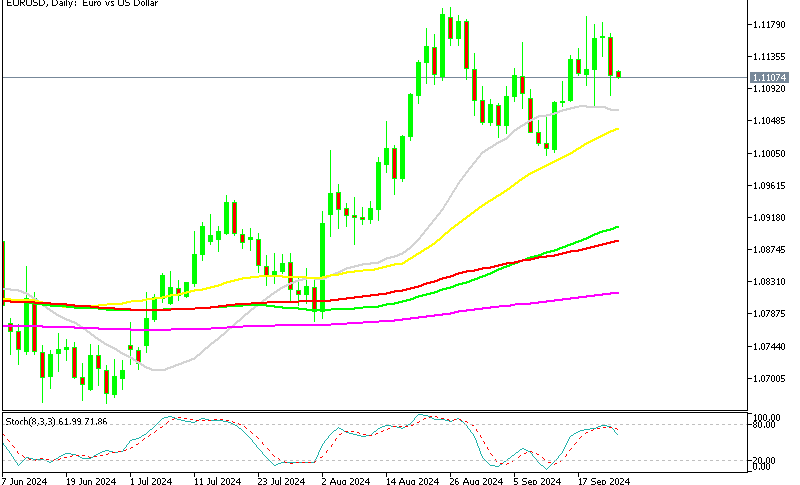

The EUR/USD pair held above 1.11 last week, even amid poor economic data from the Eurozone, but began to slide following today’s weak PMI report. The rise in the pair earlier was primarily driven by the weakening of the US dollar, which started declining after the Fed cut interest rates by 50 basis points on Wednesday night. However, the Euro’s weakness has now overtaken that of the USD, with the pair dropping below 1.11 after disappointing August PMI results for both manufacturing and services across Europe.

EUR/USD Chart – Double Top Pattern Points to 1.08

Meanwhile, other major currencies managed to gain strength against the USD. At the close of Q3, the eurozone economy appeared to be stagnating, dashing hopes for an ECB rate cut in October. Market participants had only priced in a 35% chance of such a cut last week. But over the last few sessions, expectations have climbed, and today traders are pricing in a 77% likelihood of a rate cut next month.

This has placed additional pressure on the euro, with the EUR/USD falling from 1.1145 to a low of 1.1092. While market expectations now see a 68% chance of a cut in October, ECB officials seem more inclined to hold off until December. The final decision will heavily depend on upcoming economic data, which hasn’t been promising either—today’s German Ifo Business Climate data further underscored the Eurozone’s economic challenges.

German Ifo Business Climate for August

- September Ifo Business Climate Index:

- Came in at 85.4 points (vs. 86.0 points expected)

- Down from 86.6 points in August

- Current Conditions Index:

- Fell to 84.4 points (vs. 86.0 points expected)

- Previous reading was 86.5 points

- Expectations Index:

- Dropped to 86.3 points (vs. 86.4 points expected)

- Prior value was 86.8 points

- Key Insights:

- The German business climate worsened further in September

- Current conditions show persistent economic pressures

- Outlook fell to its lowest since February, reflecting growing concerns about future business prospects

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account