Forex Signals US Session Brief, February 23 – The Price Action Is Telling Us Tales Today

The forex market has reached a blind spot and it is uncertain what to do now. It pushed against the USD last week, while this week the Buck pushed back. So today, the forex market has been trading in a tight range. Cryptocurrencies were on a bearish trend in the last two days, but today they have popped higher after reaching some major moving averages. Is the price action telling us that the uptrend resuming?

We can use the price action to tell us what the market thinks at the moment

The Forex Market Is Confused but There’s Demand for Safe Havens

After several days of the USD trending higher, the market now has reached a place where it doesn’t know what to do next. In the last two days, we have seen some spikes in major forex pairs but they turned out to be nothing.

Yesterday, USD sellers had another go. They pushed the Buck nearly 100 pips lower, but the buyers pushed back during the night. Although, the buyers couldn’t push above yesterday’s highs. This means that the buyers are not sure either if they want to keep buying the US Dollar.

If they were sure enough, forex majors would have broken yesterday’s high/lows. But, the price action today looks pretty numb, apart from the price action in NZD/USD. This pair dived 60 pips lower last night without good reason, so it has turned even more bearish now.

On the other hand, safe haven assets are enjoying some nice bids. Gold has bounced off the 50 SMA on the H1 chart, while USD/JPY and EUR/CHF keep grinding higher.

The Retrace in Cryptocurrencies Might Be Over

Cryptocurrencies have been on a bearish trend in the last couple of days. That came after the two-week climb. Most major cryptos doubled in value during those two weeks, including Bitcoin.

That climb though, came after several weeks of a steep pullback lower from record highs. Before the pullback, cryptocurrencies were in the middle of the gold rush which took Bitcoin nearly to $20,000.

As you can see from these periods which the crypto market has gone through during the last several months, the moves are getting smaller. We saw a crypto craze late last year which sent them exploding higher.

Now, this new market has come back to its senses, thank God. So, in the last two days cryptos were trending down. Today though, we are seeing a reversal of that short term trend. Bitcoin was trading around $9,500 last night, while now it has climbed back above the $10,000 level.

In fact, the reverse started when some major digital currencies reached the 100 SMA on the daily chart. Ethereum and Litecoin kissed this moving average last night and they made a sharp reversal higher, pulling Bitcoin up with it.

So as you can witness for yourself, moving averages are working pretty well in this new financial market which means that crypto traders are using them. Anyway, today’s bullish daily candlestick is bigger than the bearish candlestick yesterday. So, it looks like cryptos are reversing higher now.

The 100 SMA has been solid support for Ethereum this month

Trades in Sight

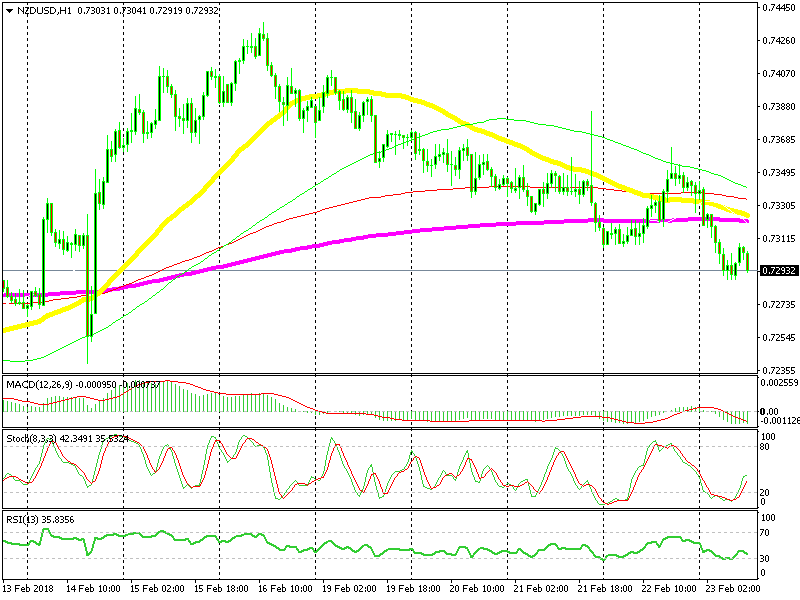

Bullish NZD/USD

- The trend is bearish

- The downtrend has picked up pace

- Moving averages are waiting above

The other moving averages are catching up with the 50 (yellow) and 200 (purple) SMAs

This pair has turned bearish this week. The downtrend was slow but it picked up pace last night when this pair made a 60 pip head dive. So, we have a bearish view on this pair and are waiting on a retrace higher to the two colliding moving averages. By that time, the other moving averages would have caught up with them and the resistance will be even stronger.

In Conclusion

USD/CAD has formed a bearish chart pattern on the daily timeframe which we will explain on the nex forex update. But, the Canadian inflation report is to be released soon and that will likely shake the CAD pairs. So, we’re not going in on this pair just yet.