Forex Signals US Session Brief, June 5 – UK Services Steal the Show as the RBA Goes by Without Much Notice

The cash rate and the statement from the Royal Bank of Australia (RBA) was the main event on the economic calendar today. However, it went by pretty smoothly without disturbing the AUD markets. The cash rate and the statement didn’t offer any surprises and the AUD didn’t even notice that event.

The UK services PMI report took a lot of attention though. It came higher than last month and it beat expectations as well, so the GBP received some strong bids after the release. Later in the afternoon, we have the US ISM non-manufacturing PMI on our radar, as well as the JOLTS jobs openings and the global dairy trade (GTD) auction prices, which might affect the NZD.

The European Session

- RBA Cash Rate & Statement – The RBA was expected to hold the interest rates, or the cash rates as the Aussies call them, unchanged. They did leave the rates unchanged, so no surprise there. The attention was on the statement. The statement from the RBA was pretty much the same as well. Although, two comments stand out. The RBA accepted that inflation is likely to remain low for quite some time and that household consumption remains a source of uncertainty. These are dovish comments from the RBA, but a bigger risk is emerging for Australia in my opinion. The Chinese are increasing imports from the US and that is likely to hurt some Australian exports. Perhaps they will address this later in the year after seeing its effects.

- European Services PMI – Today was a services day for Europe and the UK. It kicked off with Spanish services report which came at 56.4 PMI points, up from 55.6 points last month. That was a decent reading and at 53.1 points, the Italian services posted an increase as well, albeit not much. But the rest of Europe didn’t follow through. French services remained unchanged at 54.3 PMI points and so did German services which came at 52.1 PMI points as last month. At 53.8 points, the Eurozone also remained at the same levels as the previous month. One thing is positive here: the service sector is not softening, like other data has shown in Q1.

- UK Services PMI – The UK services report took all the attention during the European session. This figure jumped to 54 PMI points, up from 52.8 previously. That is the second positive surprise from the UK after the pickup in construction that we saw yesterday. It’s a turnaround after many weeks of very soft economic data from Britain.

- Eurozone Retail Sales – Retail sales were expected to grow by 0.5% but they only grew by 0.1%. That is a disappointing number, but at least last month’s number was revised up from 0.1% to 0.4%. That took some of the negativity off this report although the Euro started turning bearish after the release. The yearly retail sales number came at 1.7% though, up from 1.5% last month, so it is not a bad report after all.

The US Session

- Canadian Labour Productivity – Labour productivity is expected to tick higher to 0.3% from 0.2% previously. That would be negative for the CAD though. Lower productivity means more working hours and more people employed, so it translates into more cash flowing into the economy. In the long term, lower productivity is negative, but it helps in the short term. If this data misses expectations, then it will be good for the CAD.

- US ISM Non-Manufacturing PMI – The US final services are expected to remain unchanged at 55.7 PMI points. The non-manufacturing PMI is expected to move higher to 57.9 PMI points from 56.8 points currently. That would be positive for the USD since it would bring this sector back at really decent levels after the miss that we saw last month.

- JOLTS Job Openings – This report is released more than a month late, but it is a leading indicator for employment. It is expected at 6.5 million, just a tad softer than the previous reading, but it is still a decent number if it remains above 6 million.

- GDT Price Index – There isn’t an exact time for this release and there is no expectation since it is an auction. But it affects the NZD since New Zealand is a major dairy producer and exporter. The prices increased by 1.9% last month, which is positive after a few negative months previously.

Trades in Sight

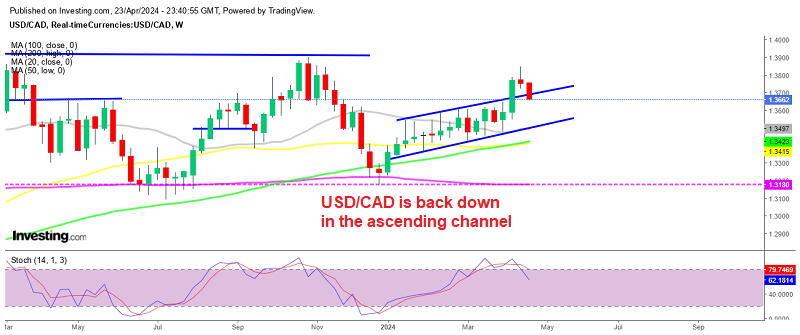

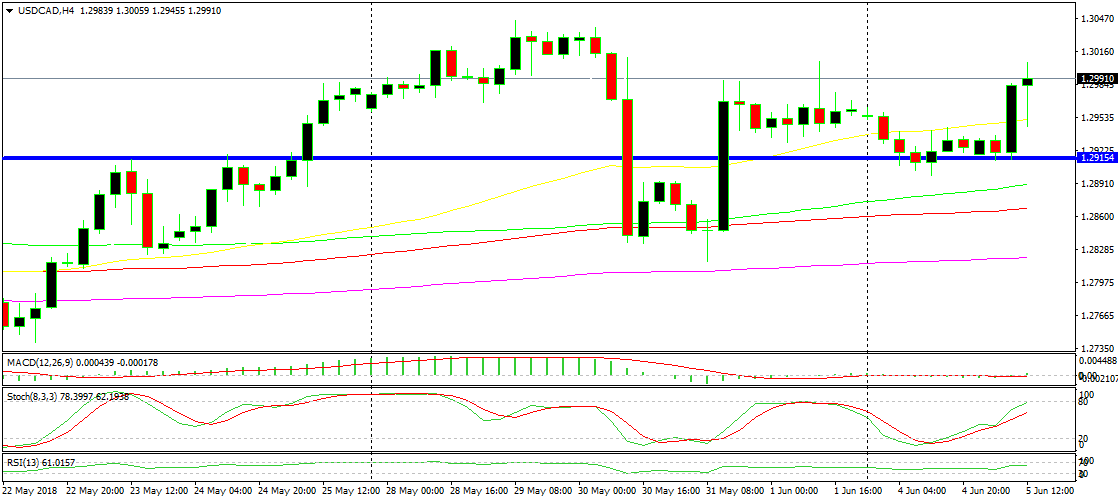

Bullish USD/CAD

- The trend today is bullish

- Commodity currencies are declining as a group

- Oil is tumbling

The bullish price action has resumed again today for USD/CAD

Oil prices continue to tumble today. The US Oil producing firms are increasing their fracking operations and Canada is increasing oil production too. Besides that, the US has asked OPEC to increase the output so Oil prices are taking a hit. The CAD is the first loser in such conditions, so our bias for USD/CAD is bullish. This pair jumped 100 pips higher today and if it retraces back lower again, we might be persuaded to go long.

In Conclusion

The services from Europe and the UK leaned a bit on the positive side. In the US session, the US services and non-manufacturing reports will be released. They might not move the markets at all, but they might turn things around if the deviation is too big. So, we will follow that closely later on and probably trade that report as well.