First of all, we had to close our gold trading signal manually with 10 pips profits as the market started presenting reversal setups. Looks like it was a good idea, as gold prices are not holding below our entry price of 1,276.

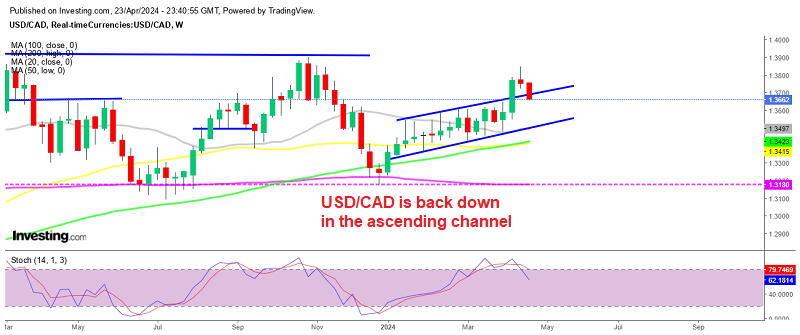

At present, the USD/CAD remain in highlights due to the upcoming inflation report. In March, the CPI figure came out at 0.7%, beating February’s gains of 0.1%. An inflation rate of 0.7% is on the cards now.

On the technical side, USD/CAD is stuck in a broad trading range of 1.3400 – 1.3290. Both leading and lagging indicators are suggesting bearish bias. The RSI value is under 50 while the USD/CAD is also trading below 50 periods EMA. On the upper side, the violation of bullish breakout can lead USD/CAD towards 1.3445. While support prevails at 1.3250.

Support Resistance

1.3335 1.3393

1.3312 1.3427

1.3255 1.3484

Key Trading Level: 1.3369

A CPI > 0.70% can trigger sharp sell-off in the USD/CAD, so we might need to capture a sell as per mentioned trading levels. While an inflation rate of 0.5% or less can trigger dramatic buying in the USD/CAD pair.

Good luck!