Daily Brief, Sep 26: Economic Events Outlook – Central Bankers’ Speeches & US GDP in Highlights

On Thursday, the US dollar is trading mostly steady, after exhibiting dramatic bullish trends during the US session. The dollar strengthened on Thursday, lingering near multi-week highs versus most of its peers amid positive talks between the US & China.

The US President Donald Trump stoked chances for a trade agreement by informing journalists in New York that the US and China were having “good conversations” and that a deal “could happen sooner than you think.”

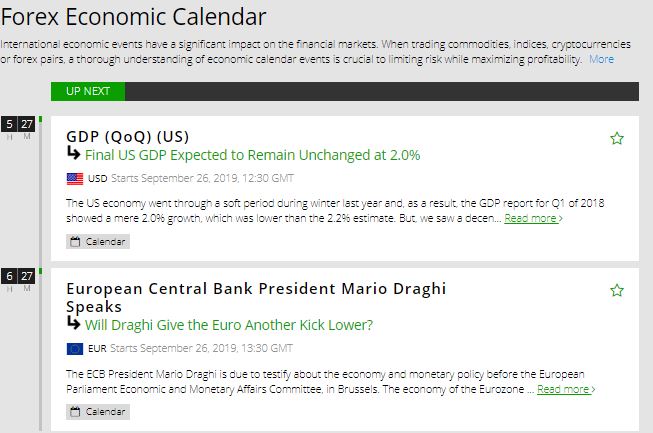

Looking ahead at the economic calendar, a series of speeches from the BOJ Gov Kuroda, ECB President Draghi and BOE Gov Carney will remain in highlights. Besides, the Final GDP figures from the US will also help drive price action in the market.

USD – Final GDP q/q – 12:30 GMT

The Bureau of Economic Analysis is due to release figures for Final GDP. The GDP stands for Gross Domestic Product and represents the annualized change in the inflation-adjusted value of all goods and services produced by the economy.

The final data of the US GDP for the second quarter is anticipated to affirm the prior figure of 2% annualized growth. The GDP has finally gained some momentum after falling dramatically from 4.2% in September 2018 to 2% in June 2019.

Since it’s a quarterly figure, the impact is most substantial on the US dollar, stock markets, and the bullion market.

USD – Unemployment Claims – 12:30 GMT

The Department of Labor is releasing the jobless claims data for the US. Lately, the figures have been neutral and continue to stay around 200K. Due to the lack of significant deviation, the data will Monda mostly have a muted impact.

For newbies, the figure reports the individuals who filed for unemployment insurance for the first time during the past week. Economists are expecting 210K jobless claims which are slightly higher than 208K during the previous week.

EUR – ECB President Draghi Speaks – 13:30 GMT

The European Central Bank President Mario Draghi is due to deliver opening remarks at the European Systemic Risk Board annual conference, in Frankfurt.

As head of the ECB, which controls short term interest rates, he has more influence over the Euro’s value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

Investors may keep an eye on the event, but Mario Draghi has already shared most of the forward guidance, and in this event, we may not hear anything on upcoming interest rate decisions.

GBP – BOE Gov Carney Speaks – 13:45 GMT

The Bank of England Governor Mark Carney is also due to participate in a panel discussion about the future of financial services at the European Systemic Risk Board annual conference, in Frankfurt.

Similar to ECB’s Mario Draghi, BOE’s Mark Carney will also be likely to discuss the global economic risks and ways to cope with such scenarios. Not much volatility is expected from the event.

USD – Pending Home Sales m/m – 14:00 GMT

The National Association of Realtors is due to report a change in the number of homes under contract to be sold but still awaiting the closing transaction, excluding new construction.

This data is released about a week later than Existing Home Sales, but it’s more forward-looking as a contract is signed several weeks before the home is counted as sold.

Economists are expecting another negative figure from pending home sales, but this time it’s likely to be -1% vs. -2.5%. Typically, this kind of figure places bearish pressure on the US dollar.

Let’s stay tuned to FX Leaders Economic Calendar for live market updates and forex trading signals.

Good luck!