US Durable Goods Orders Jump Higher in May

As the US went into lockdown in March and April, all sectors of the economy went through some deep contraction. Retail sales also fell hard, as did durable goods orders, since the future wasn’t too certain with the coronavirus pandemic around. But, as the economy started to reopen, durable goods orders were going to jump higher, with businesses expecting to re-start life once again. Below are the durable goods orders figures for May:

May 2020 US Durable Goods Orders Report

- May prelim durable goods orders +15.9% vs +10.5% expected

- Final April reading was -17.7% (lowest on record)

- Excluding transport +4.0% vs +2.1% exp (-7.7% prior)

- Capital goods orders non-defense ex-air +2.3% vs +1.0% exp

- Prior capital goods orders non-defense ex-air -6.1% (revised to -6.5%)

- Capital goods shipments non-defense ex-air +1.8% vs -1.0% exp

- Prior shipments -5.7% (revised to -6.2%)

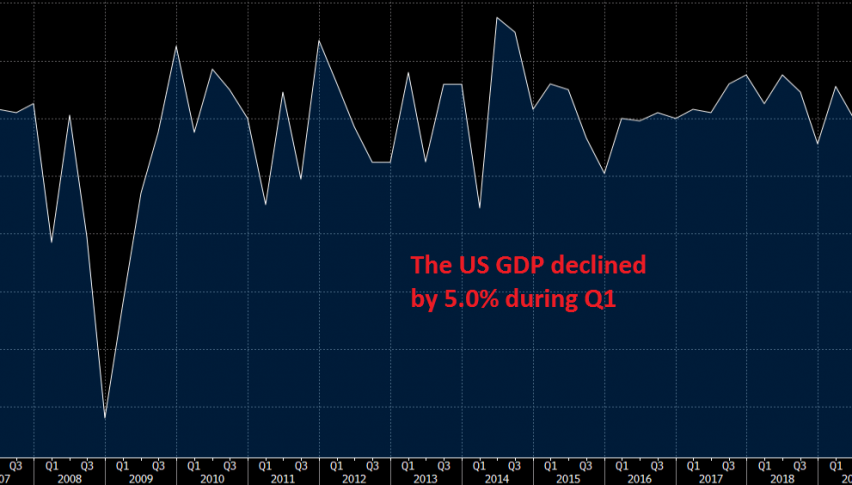

These are some good numbers and show a strong rebound in May. It’s nice to see it in hard data rather than in soft surveys. The last reading for the Q1 GDP was released at the same time and it didn’t show much of a change from the previous readings, which was revised lower to 5.0%, from 4.8% in the first reading.

The US Q1 2020 GDP data

- Q1 GDP (third reading) -5.0% vs -5.0% expected

- Second reading was -5.0

- Q4 2019 reading was +2.1%

Details:

- Final sales -3.5% vs -3.7% prelim

- Consumer spending -6.8% vs -6.8% prelim

- GDP deflator +1.6% vs +1.6% prelim

- Core PCE +1.7% vs +1.6% exp

- Business investment -6.4% vs -7.9% prelim

- Corporate profits after tax -12.4% vs -14.2% prelim

Inventories cut 1.56 percentage points from GDP. The market is looking towards Q3 now and it’s on track to be the worst quarter on record. But, even Q2 is sort of history now since we are only one week until the end of this quarter.