EUR/USD has been bullish for several months, as the Euro has gained some momentum. But, the main reason has been the increased weakness in the USD, which has sent the Buck tumbling lower against all pairs. As a result, this pair has climbed more than 10 cents in the last few months.

But, it seems like the upside momentum might have ended, at least for now. EUR/USD made a new high last Monday, climbing to 1.1960s, but it turned lower from there and has been declining since then, making lower highs, which is a sign that the pressure has shifted to the downside now.

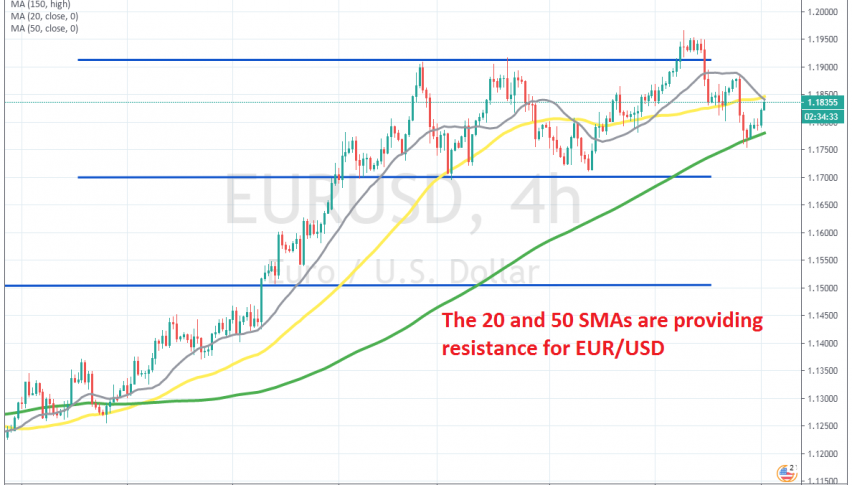

By the middle of last week, the price found support at the 50 SMA (yellow) on the H4 chart. EUR/USD bounced from there, but the 20 SMA (grey) turned into resistance, reversing the price back down. EUR/USD fell to 1.1750 last Friday, but the other moving average held as support and today we are seeing another bounce higher. Although, the bounce seems over now, while the 20 and 50 SMAs are providing resistance, so we decided to take this opportunity and go short on this pair. Now we are waiting for the bearish trend to resume again.