US Dollar Still Mostly Steady Even as Risk Appetite Returns to Markets

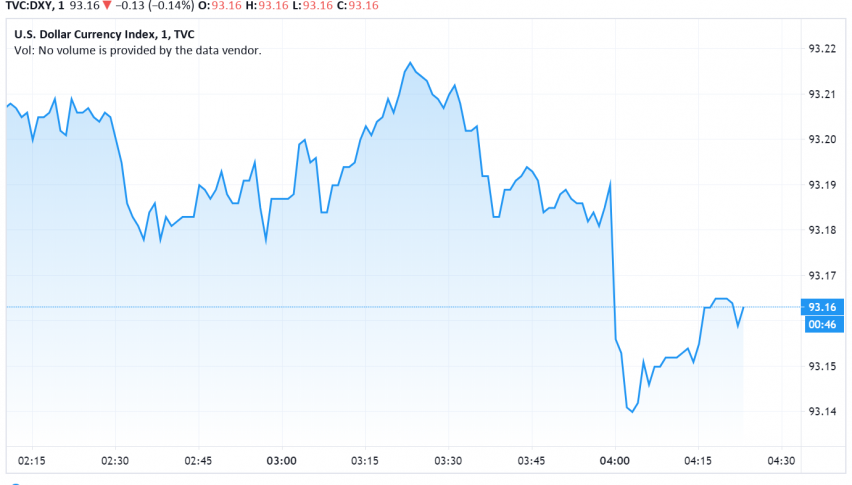

Early on Tuesday, the US dollar continues to trade steady, unaffected by selling pressure amid an improvement in risk appetite in global equities, as traders cautiously look forward to the upcoming Jackson Hole symposium before making their moves. At the time of writing, the US dollar index DXY is trading around 93.16.

During the previous session, US stock markets rallied higher, supported by promising reports about possible treatment options for coronavirus. The US dollar typically loses its sheen when the risk sentiment improves as traders move from its safe haven comfort towards the riskier equities.

However, the dollar remained unmoved by the change in direction in financial markets as traders wait to hear from Fed chairman Jerome Powell on the central bank’s monetary policy. Especially of interest will be any change in the Fed’s approach towards inflation, with markets expecting Powell to announce that the 2% inflation target could turn into an average from a nominal aim.

The US dollar also enjoyed some support from a strengthening in bond yields over the previous session. Despite the current moves, the dollar has lost more than 9% of its value since the highs touched back in March, when it gained as a safe haven currency, at the beginning of the coronavirus pandemic.