2 More Indicators Pointing Up for the US Economy

The US economy has been doing pretty well in recent month. The restart after the reopening took some time to get the economy going, but it caught up and there are no signs of slowing down, as all sectors are steaming at the moment and the trend points to further expansion int he coming months.

That’s despite the slowing global economy and the unrest in the US, which is hurting businesses in some states, like New York and Los Angeles. In the previous week we saw manufacturing activity surge in the US, now we are seeing a surge in services, among other sectors, as the ISM and PMI reports released yesterday showed.

That came after the unemployment claims data showed that jobless claims had fallen below 1 million again last week. So, everything looks great economically in the US, which a little surprising and impressive a well.

August 2020 ISM services report

- ISM August services index 56.9 vs 57.0 expected

- July services index was 58.

- Business activity 62.4 vs. 67.2 last month

- New orders 56.8 vs. 67.7 last month

- Nacklog of orders 56.6 vs. 55.9 last month

- Employment fell to 47.9 from 42.1 last month

- New export orders 55.8 vs. 49.3 last month

- Imports 50.8 vs. 46.3 last month

- upplier deliveries 60.5 vs. 55.2 last month

- Inventory change 45.8 vs. 52.0 last month

- Inventory sentiment 52.5 vs. 50.0 last month

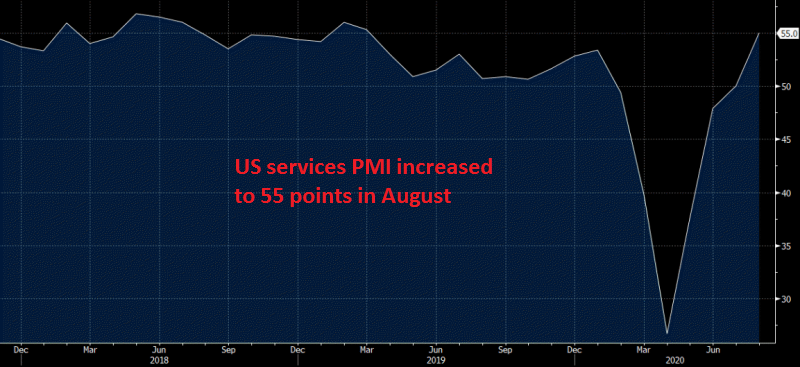

Services PMI from Markit for Aug 2020

- August services PMI 55.0 points vs 54.7 expected

- Highest level since March 2019

- Prelim services were 54.8 points

- July services PMI was 50.0 points

- Composite index 54.6 vs 54.7 prelim

- New orders rose at the quickest pace in a year