The Eurozone Economy Remains Volatile, As Retail Sales Show

The global economy is recovering now after the recession we saw in spring last year due to the lock-downs and the restrictions this winter. Although, the Eurozone is lagging behind other countries, with services still in recession due to the new lock-downs across the continent.

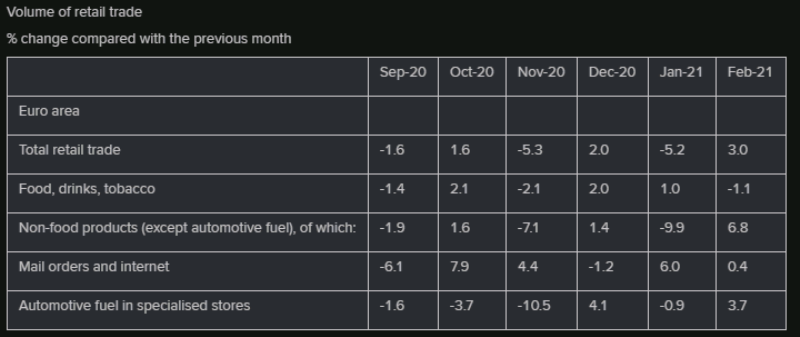

Restrictions are beginning to ease now, with the spring here, but the economy remains volatile. Retail sales have been turning positive and negative from month to month and continue that trend, as February’s report shows.

Eurozone February Retail Sales Report – 12 April 2021

- February retail sales +3.0% vs +1.7% m/m expected

- January sales -5.9%; revised to -5.2%

- Retail sales -2.9% vs -5.3% y/y expected

- Prior -6.4%; revised to -5.2%

After more subdued January activity, which was also impacted by winter demand, euro area retail sales bounced back a little in February – mostly from non-food sales (+6.8%). That said, relative to a year ago (pre-COVID), overall conditions are still relatively subdued with non-food sales being down by 5.5% as compared to February 2020 levels. EUR/USD has bounce 45 pips higher nonetheless this morning, after the report was released.