⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

Buying USD/JPY at the 100 SMA, With Markets Undecided Between Risk On/Off

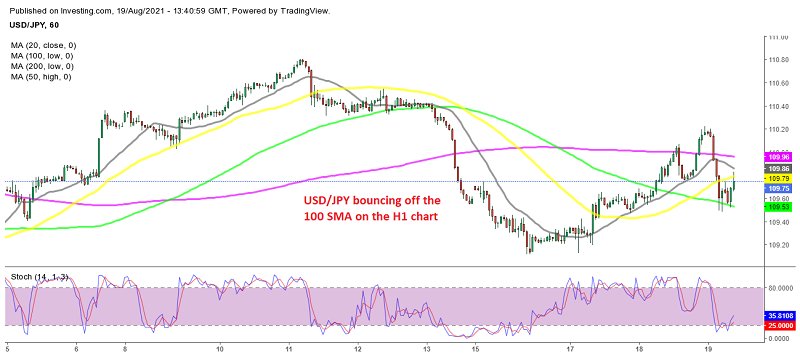

USD/JPY has been sort of volatile recently, especially since July, as markets are trying to decide whether to keep up the risk-on sentiment, which is negative for safe havens such as the JPY, or turn to the risk-off mode. The USD has been undecided as well, which has kept this pair bouncing up and down.

This week, we have seen a bullish price action in the USD/JPY, which took this pair around 100 pips higher, while earlier today we saw a bearish reversal. But, the 200 SMA (green) seems to be holding for now, so we decided to take a small trade here and opened a buy signal. This pair is already starting to bounce, and the US unemployment claims, which continue to decline, are now also helping the USD slightly.

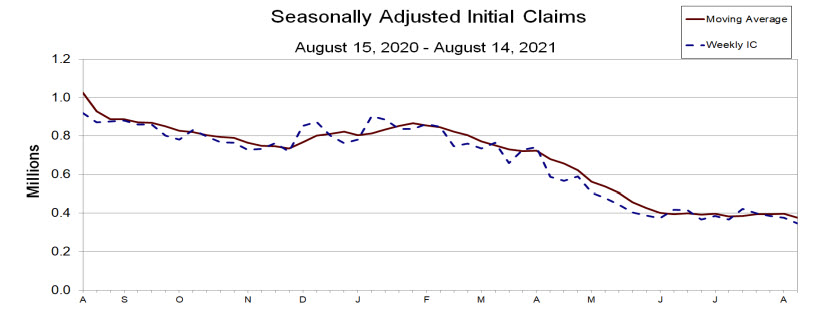

US weekly initial jobless claims and continuing claims data

- Initial jobless claims 348K vs 362K estimated. This is a post COVID low (since March 14, 2020)

- Prior week came in at 375k revised to 377K

- 4-week moving average initial claims 377.75 versus last week’s 396.75 (-19,000 on the week)

- continuing claims 2820K versus 2800k estimate

- 4-week moving average continuing claims 2998.75K versus 3109.25 last week. This is the lowest level since March 21, 2020.

The initial claims data corresponds with the survey week for the BLS employment report next week. Being the lowest level since March 14, 2020, the trend is positive for that report.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments