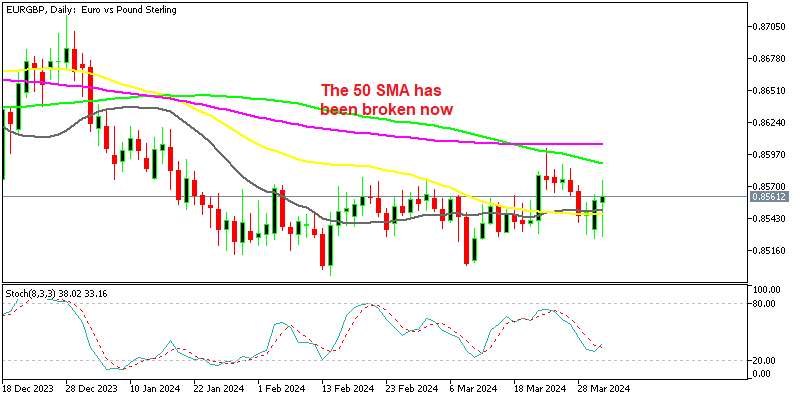

Bearish Reversal in EUR/GBP, As Factors Weigh in Favour of the Pound

EUR/GBP turned bullish in August, as the situation was more in favour of the Euro, with the political trouble ini the UK, besides everything else that has been going on. Most UK economic indicators fell in contraction, which turned the GBP really bearish. Although now the factos are turning slightly in favour of the USD, while EUR/USD is trading below 1, which indicates that market forces want this pair below parity.

Liz Truss who is widely expected to be named the new leader early this afternoonannounced a GBP130 billion plan to fix energy bills. The news appears to partially ease the market’s concerns that Truss’ promised tax cuts would ultimately worsen the inflation picture. Analysts are fearful that the expected jump in energy costs will hurt the British economy further, closing many small businesses, hence the bearish momentum in the GBP previously. So, this news is a great relief for the GBP, with the GBP remaining steady, while the Euro is looking weak once again.

EUR/GBP H4 Chart – The 20 SMA Turns Into Resistance

The trend has reversed this week

The plan would be to freeze energy bills at the current price level for this winter and the next but the catch here is that they are to be paid for by government-backed loans to energy suppliers. So, what’s going to happen next? BBC reports that “those loans would be repaid over the next 10 to 20 years through supplements to customer bills”. To cut short, it is households who will have to pay for them eventually i.e. the cost is just being spread out for a longer period instead.

Nonetheless, the GBP is happy and EUR/GBP has fallen below the 20 SMA (gray) on the H4 chart, which has turned now into a resistance, suggesting that the pressure has shifted to the downside. Now buyers are facing the 50 SMA (yellow) and we might see a bounce off this moving average before the next move lower.