May 28 – Top Trade Setup In Forex – Risk on Sentiment Peaks

Good morning, traders.

As discussed in the FX Leaders Weekly Economic Events report, the market is expected to exhibit thin trading volume today. Most U.S. and European markets are closed in observance of Memorial Day and the Spring Bank Holiday. Surprisingly, the market has opened with massive gaps.

Gold is down by -6.10 points and the dollar index dipped 0.41% early this morning.

What’s happening in the market?

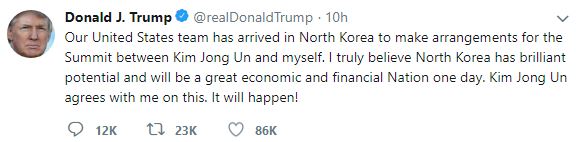

The risk-on sentiment eased after the President Donald Trump’s newest tweets:

“Our United States team has arrived in North Korea to make arrangements for the Summit between Kim Jong Un and myself,” Trump said in a tweet on Sunday afternoon.

“I truly believe North Korea has brilliant potential and will be a great economic and financial Nation one day,” Trump added. “Kim Jong Un agrees with me on this. It will happen!”

Consequently, investors are pulling out of the safe haven asset gold while moving their investments into risky securities, such as a stock and indices. Let’s look at the forex setups…

USD/CAD – Triple Top Breakout

Last week, the USD/CAD continued to trade sideways, below a strong resistance level of $1.2885. The commodity currency loonie has weakened after a massive dip in the prices of crude oil, violating the triple top resistance level of $1.2885. For the moment, it’s trading bullish near $1.2975, right below a solid resistance level of $1.2995.

What makes this level ($1.2995) more interesting is that the RSI and Stochastics holding in the overbought region. You can also see a bearish Marobozu candlestick pattern on the 2-hour chart which clearly shows that the technical indicators are lining up with the bearish setup. This shows that the bulls might be losing momentum.

USD/CAD – Key Trading Levels

Support Resistance

1.2965 1.2983

1.2954 1.299

1.2947 1.3001

Key Trading Level: 1.2972

USD/CAD – Trading Plan

The Loonie is following a new trading range of $1.2970 – $1.2995. Within this range, we don’t need to do much. However, a breakout will help us determine the future direction of the USD/CAD. On the lower side, the USD/CAD can target $1.2925, and $1.3050 is likely to be a bullish target. Good luck and have an awesome day!