US Session Forex Brief, Apr 12 – Sentiment Turns Positive Before the Weekend Close in Financial Markets

Financial markets have been quite uncertain this week, with the sentiment shifting from positive to negative from one session to another and vice versa. Most financial assets have been trading in tight ranges, with commodity currencies bouncing up and down while stock markets were trying to make up their mind until this morning whether to turn bearish on large time-frames or to remain bullish.

Today, stock markets have made their mind up and they are running higher as the sentiment has improved considerably. Risk currencies have been climbing higher pretty fast during the Asian and the European session, while safe havens are sliding lower. Although, we had a sign yesterday that the sentiment was about to turn positive as GOLD had a really bearish day, while USD/JPY ended the day around 80 pips higher.

Today everything looks great as the sentiment remains buoyant with risk assets pushing further up. One of the reasons for this improvement in the sentiment was the Chinese data this morning, especially the trade balance, which jumped higher. This is making traders think that the slowdown of the Chinese economy should be over, which would also help the global economy that is also slowing down. But if you look at the details of the trade report from China, you see that the exports have increased by 1.4% on an annualized basis but imports have declined by 4.8% which shows that the Chinese consumption and the domestic economy are continuing to decline. But, markets see what they want to see and everything is running higher apart from safe havens.

European Session

- German WPI – The whole price index declined in December and January in Germany, probably due to the effect of falling Oil prices. But, it turned positive again in February, growing by 0.3% as last month’s report showed. Today’s report showed another increase of 0.3% in March and a 1.8% increase on a yearly basis from 1.6% previously. This implies that domestic demand remains decent in the German economy in Q1 at least, helping to cushion the blow of a weakening manufacturing sector.

- Chinese Trade Balance – The USD-denominated trade surplus has been declining in the first two months in China and last month it fell to just $4.1 billion, reflecting the Chinese economic slowdown. Although today the balance was expected to increase to $7.7 billion, in fact it jumped higher to $32.6 billion. The total trade balance also increased to ¥220 billion against ¥178 billion expected. But, the problem is that while exports increased, imports fell further, which shows that the Chinese economy and the consumer are not doing so well domestically.

- Chinese New Loans and M2 Money Supply – The value of new Yuan-denominated loans issued to consumers and businesses took a dive in February falling below ¥1,000 billion. New loans were expected to increase to ¥1,223 billion in March but increased further to ¥1,690 billion. The M2 money supply also increased from 8.0% previously to 8.6% in March, beating expectations of a 8.2% increase. This shows that the monetary and fiscal stimulus are working their way through the financials of the Chinese economy at least.

- Eurozone Industrial Production – The industrial production has been more negative than positive in the Eurozone during 2018 and closed last year with two considerable declines in November and December. In January this year, production made a decent jump of 1.4% which was revised higher today to 1.9%, but today’s report showed that in February production fell again by 0.2%. Although, that was lower than the 0.6% decline expected.

The US Session

- 2nd Brexit Referendum for Hammond – UK Financial Minister Philip Hammond said a while ago that a second referendum is very likely to be put to Parliament at some stage, but the government would not support a second referendum. Chances of a second referendum depends on Labour, which is deeply divided on this. There are some disagreements with Labour on Brexit priorities but there is agreement on fundamentals. He is optimistic that they will get a Brexit deal in next couple of months. The UK will have some work to do to restore its reputation after Brexit.

- US Import Prices – Import prices declined for three straight months in the US from November last year to January which was due to falling Oil prices at the end of last year, although January was revised to 0.1%. In February, prices increased by 0.6% as last month’s report showed, but were again revised higher to 1.0% today. In March, import prices were expected to have increased by 0.3% but beat expectations coming at 0.6%.

- US Prelim UoM Consumer Sentiment – The UoM consumer sentiment indicator was declining at the end of last year and in January it bottomed at 90.7 points. But it reversed in the last two months and last month’s number was revised even higher to 98.4 points from 97.8 previously. Today, the consumer sentiment is expected to come out at 98 points.

- US Prelim UoM Inflation Expectations – The UoM inflation expectations indicator has been slowing down since August last year, falling from 2.9% in August to 2.4% last month. There are no expectations for this indicator but the trend is bearish, so I expect another soft number.

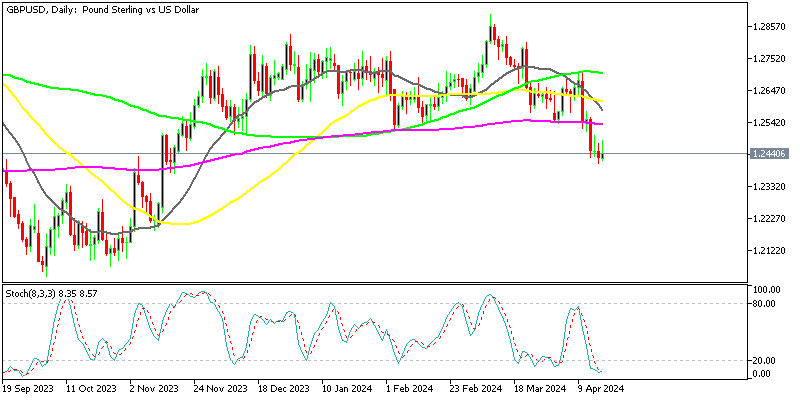

Bearish GBP/USD

- This pair is near the top of this week’s range

- The 200 SMA has been providing resistance this week

- The H1 chart is overbought

Buyers haven’t been able to push past the 100 SMA

A while ago, we decided to go short on GBP/USD. This pair has been trading in a range all week bouncing up and down. Right now, the price is near the top of the range and the H1 time-frame is overbought. The 200 SMA (purple) has also been providing resistance all week, so it seems like GBP/USD might reverse down from here. The 100 SMA is standing at these level on the H4 chart so that should add some more strength to the resistance are above.

In Conclusion

The USD continues to get beaten up across the board today as the risk sentiment continues to improve. The Japanese Nikkei has made new highs for this year and other major indices are threatening new highs. This looks dangerous for both sides since the Chinese data doesn’t show such a bearish picture and the buyers should be cautious, but at the same time, it’s the end of the week and markets behave strange some times on Friday, so beware guys.