US Session Forex Brief, Apr 16 – Forex Pairs Bounce in Tight Ranges, While Stocks Remain Slightly Bullish

Yesterday, most of the markets were sort of uncertain which direction to take, after risk assets were bullish last week, as sentiment improved in financial markets. Today we are seeing a mix of both – last week’s price action as well as yesterday’s price action. Forex remains pretty much the same as yesterday without clear direction as uncertainty prevails.

Risk currencies have retraced higher in the last two weeks since they were oversold two weeks ago, but now traders are realizing that there’s really no reason to keep buying them. We saw some green shots from the Eurozone and Chinese economic data last week, but that’s just a spark in a dark sky. Several European Central Bank (ECB) members doubted the assumed economic rebound in Q2 of this year and they might be right as most economic indicators still point down in the Eurozone.

Stock markets have resumed last week’s uptrend after trading water yesterday. The German DAX is making new highs for the year and it is at the highest levels since September last year, while SPX is threatening all time highs, trading just 40 pips below record highs. I bet Donald Trump is loving this. The GBP is sliding lower despite the positive employment report, which showed that earnings are increasing at great speed.

European Session

- Postponing Brexit – The European Council President, Donald Tusk, was speaking in Strasbourg this morning saying that a Brexit extension is ‘flexible’. He urges the UK to use this extra time in the best way possible because there will be no re-opening of withdrawal agreement. He added that the EU27 can make changes to the political declaration, him and others involved are ‘exhausted’ with Brexit, but that exhaustion is not a reason to say ‘just get over with it’. European Commission President, Jean Claude Juncker, also spoke and he said that extending Brexit beyond October is not his working assumption.

- UK Employment Report – The unemployment rate remained unchanged at 3.9%, but jobless claimant count change came at 28.3k against 7.3k expected. Jobless claims have been missing expectations continuously in the last several months. But despite the miss in jobless claims, this is yet another great employment report.

- UK Earnings Report – Earnings have been growing steadily and February’s report showed that earnings are up by 3.5% 3M/Y. Prior earnings was +3.4% but was revised higher to +3.5% today. Average weekly earnings excluding bonuses remained unchanged at +3.4% vs +3.4% 3m/y expected. The previous average weekly earnings excluding bonuses was also revised higher to 3.5%. Employment change came at 179k against 181k expected and down from 222k previously. Average weekly earnings in the three months from November to February grew by 1.6% YoY, which is the largest increase since 2016. The main numbers are pretty much in line with expectations and overall it is another good earnings report.

- Eurozone and German ZEW Economic Sentiment – The economic sentiment deteriorated considerably last year and it bottomed below -22 points, both in the Eurozone and in Germany towards the end of 2018. It has been improving since then but the sentiment was still negative until last month. Today’s reports showed that the sentiment finally turned positive this month and both numbers beat expectations today as well.

- ECB Starting to Lose Confidence – The European Central Bank shifted to dovish last month, but they have been confident that the economy would rebound in Q2 of this year. But now several ECB policymakers are said to doubt projections for growth rebound in H2 2019, according to Reuters. We are seeing some green numbers here and there, and today’s reverse in the economic sentiment is a good sign, but it’s still too early to be optimistic.

The US Session

- OECD Warns on China Policy – The OECD warned today that China’s stimulus measures could worsen structural distortions in the medium-term. In its latest survey on the Chinese economy, OECD notes that China is stepping up stimulus measures to bolster its economy this year and next. But such measures may undermine the country’s drive to control debt and worsen structural distortions moving forward.

- Canadian Manufacturing Sales – Manufacturing sales turned negative in the last three months of 2018 in Canada. Although, they turned positive again in January as last month’s report showed, but today, January’s jump was revised lower to 0.8% from 1.0%. Today’s report was supposed to show another decline of 0.1% in manufacturing sales and they turned negative again, declining further by 0.2%. Core sales which exclude autos remained positive at least, coming at 0.2% against 0.9% prior. New orders also remained positive growing by 1.5% vs 12.4% previously while inventories built up by 0.5%.

- Canadian Foreign Securities Purchases – Foreign securities purchases, which is the total value of domestic stocks, bonds, and money-market assets purchased by foreigners during the reported month, were expected at $27.34 billion, but they came at half of expectations at $12.05 billion.

- US Industrial Production – Industrial production turned negative in January as the global slowdown towards the end of last year and the US government shutdown had their effect on production. They turned positive in February but grew by only 0.1% that month which is pretty weak. Today’s report is expected to show a 0.2% increase in industrial production for March.

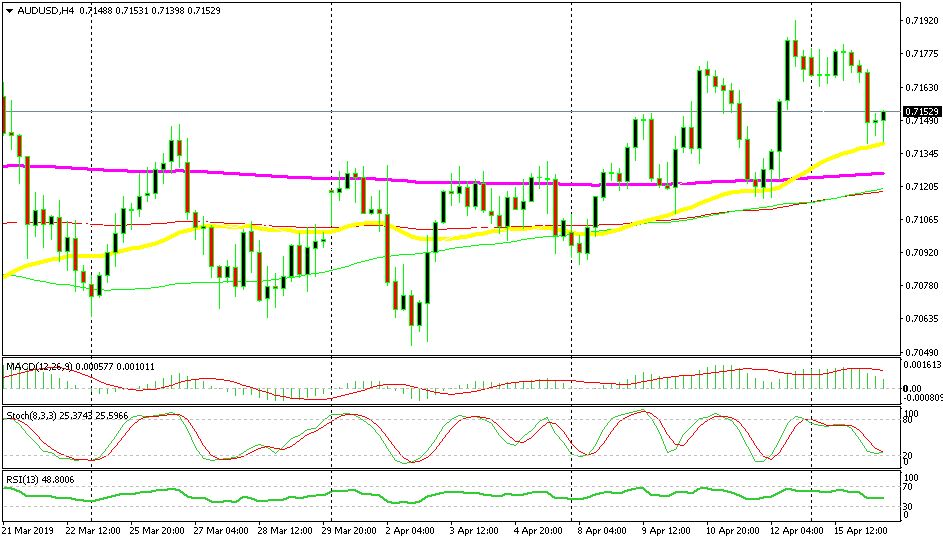

Bullish AUD/USD

- The trend is bullish

- The retrace down is complete

- The 50 SMA turned into support

- The candlestick formation points up

The 50 SMA has now turned into support for AUD/USD

AUD/USD has been trending higher in the last two weeks and the 200 SMA (purple) turned from resistance into support last week. But this week it seems that the 50 SMA (yellow) is doing its job in providing support as this pair reversed higher from there. The price formed a doji candlestick after the pullback down and stochastic was oversold as well at that time, which was the perfect setup for a bullish reversal. The reversal higher is underway now so this pair is pretty bullish.

In Conclusion

The sentiment has improved in the last couple of hours and stock markets continue to crawl higher. Although, forex pairs still look uncertain apart from the Aussie which made a quick bullish reversal as explained above. The GBP has tumbled lower on more Brexit rumours, but we and the GBP are used to this now, so I expect another reversal in the GBP in the coming sessions.