Key Macro Support Level To Watch For Bitcoin (BTC)

For Bitcoin (BTC), the month of May has been a historic period to be in the market. With only a few days left until June trade, Bitcoin is holding firm in the vicinity of $37,500. However, the losses of the past 30 days have been extreme, measuring more than 25%. In fact, BTC has posted a massive trading range of $59,603 to $30,066 for May. This is a record figure and one that is challenging the prevailing long-term bullish trend.

What has driven the sudden bearish sentiment toward BTC and cryptos? Simply put, government intervention and pending regulation. Here are the key bearish market drivers that have come to light over the past month:

- Taxation: The U.S. Treasury and IRS have hinted that crypto taxation is on the immediate horizon. In addition, the Biden administration is proposing an $80 billion increase in the IRS budget. These funds will be used to expand IRS enforcement, much of which may be focussed on the cryptosphere.

- Regulation: The SEC Vs Ripple XRP case continues to evolve and is now within the discovery phase. All in all, this is nothing new. But, it appears that the SEC is determined to press ahead with a controversial argument that XRP is a security, not a cryptocurrency.

If we know one thing about the crypto markets it’s that they don’t like regulation. May was a big month on this front and brought an enormous retracement to Bitcoin.

Bitcoin Attempts To Find Solid Ground At $37,500

For Bitcoin bulls, the calendar can’t flip fast enough. May has been a miserable month and one that crypto players won’t soon forget.

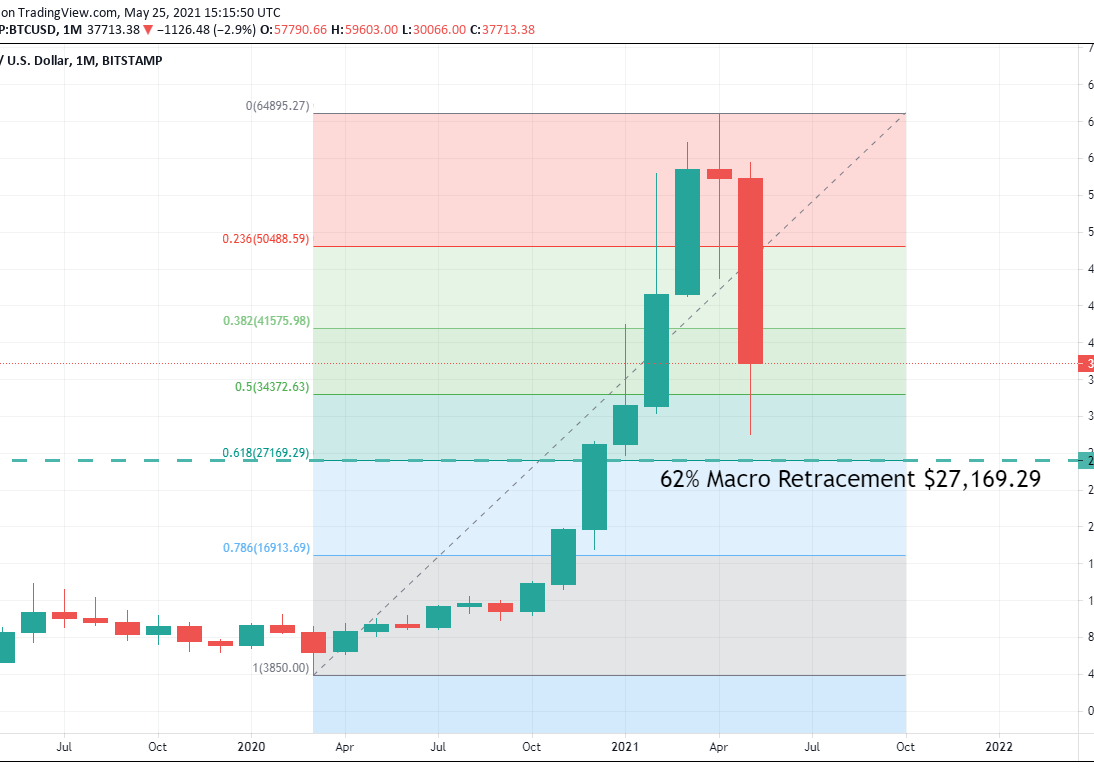

However, the negative price action has brought a few long-term support levels into play. Here are the three Fibonacci levels that may be huge factors throughout the summer months:

- Support(1): 50% Macro Retracement, 34,372.63

- Support(2): 62% Macro Retracement, 27,169.29

- Support(3): 78% Macro Retracement, 16,913.69

Bottom Line: If we see June bring more of the same to Bitcoin, some or all of these levels may come into play. For now, I’ll be looking to buy BTC from 27,750. With an initial stop loss at 22,750, this trade produces $5000 (18%) on a 1:1 risk vs reward ratio.