US Dollar Steady as Investors Turn Their Attention to Central Banks This Week

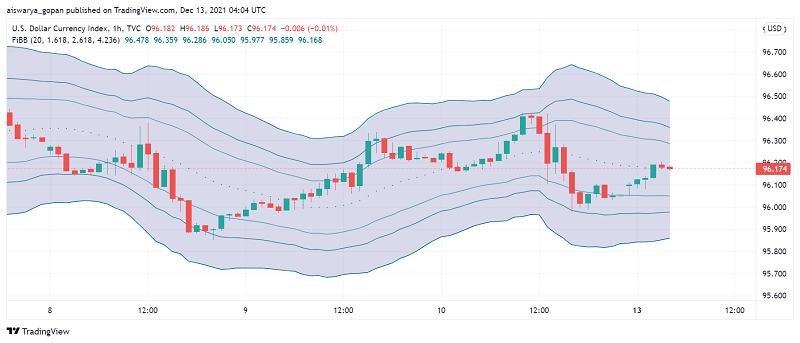

The US dollar is trading cautiously at the start of new trading week after going through considerable volatility over the past several sessions over the Omicron variant of COVID-19, first gaining as safe haven and then sliding lower as concerns eased. At the time of writing, the US dollar index DXY is trading around 96.17.

This week’s focus shifts away from the pandemic and towards central bank meetings, especially the Fed’s last FOMC of the year coming up. Investors will closely monitor policymakers’ statements for any clues on speeding up the tapering of asset purchases as they could signal a possible timeline for the first post-pandemic rate hike by the Fed.

According to CME’s FedWatch, there is over 50% likelihood of the Fed hiking interest rates by May 2022. Any announcement concerning speeding up the tapering of monetary stimulus can support the US dollar and help it trade higher against other leading currencies.

Beyond the US, five other members of the G10 nations are scheduled to hold their central bank policy meetings this week, giving plenty of drivers to forex markets in the coming days. We will get to hear from the ECB, BOJ, BOE, SNB and the Norges Bank as well this week.

There is also a slight hope among investors that the ECB could signal some hawkish tones at the upcoming meeting, which could lend some support to EUR/USD. On the other hand, the BOJ is likely to stick with its ultre-dovish policy, which could see USD/JPY strengthen to trade around the 115 level in the near term.