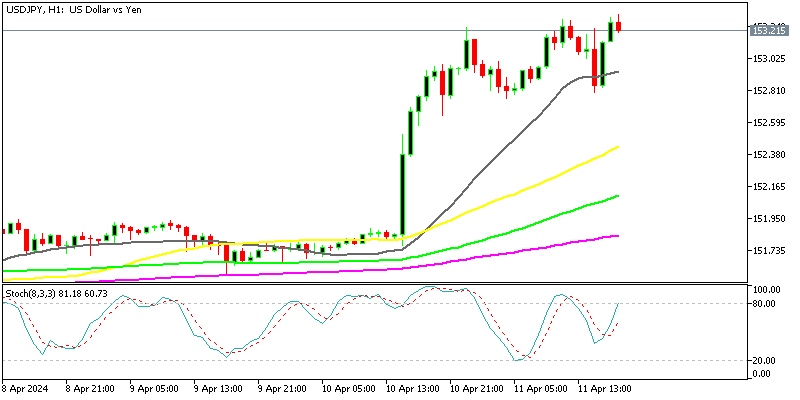

Retesting USD/JPY Longs Again, After Casing in on Yesterday’s Signal

Yesterday we decided to open a buy signal on USD/JPY as this pair was retreating lower. This pair has been on a bullish trend since the beginning of 2021 and recently the upside has picked up further momentum again. Our signal closed in profit last night, but today we are seeing another retreat lower, which looks like another good opportunity to buy this pair.

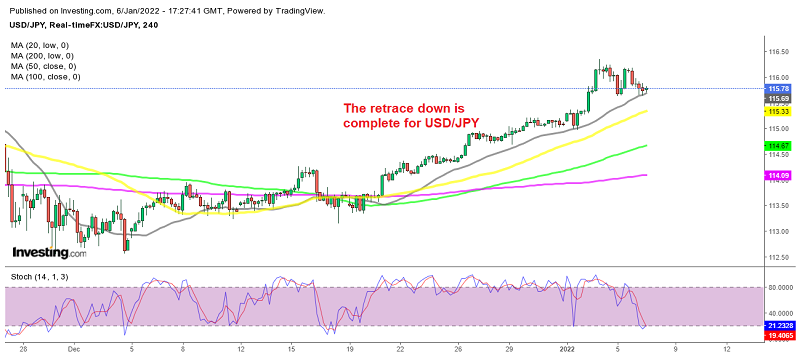

The price is finding support at the 20 SMA (gray) on the H4 chart and stochastic is oversold, which points to a bullish reversal. Yesterday the consumer spending contracted further in Japan which is weighing on the JPY. Today the US ISM services report showed a slowdown for December, but that was expected and this sector still remains in a good expansion, so USD/JPY should resume the upside momentum soon.

ISM non-manufacturing data for Dec 2021

- December services PMI 62.0 points versus 66.9 expected

- November was 69.1 points (record high)

- New orders 61.5 points versus 65.0 estimate. Last month 69.7

- Employment index 54.9 points versus 54.1 estimate. Last month 56.5

- Prices paid 82.5 points versus 83.6 estimated. Last month 82.3

- Business activity 67.6 points versus 71.0 expected (prior 74.6)

- Supplier deliveries 63.9 points versus 75.7 last month

- Backlog of orders 62.3 points versus 65.9 last month

- New export orders of 61.5 points versus 57.9 last month

- Imports 55.5 versus 50.5 points last month

- Inventory sentiment 38.3 points versus 36.4 last month

- Full report

Comments in the report:

- “Supply chain challenges to procure supplies for our restaurants remains our greatest obstacle at present, along with staffing needs. We are considering another price increase after just one in 2021, in August.” [Accommodation & Food Services]

- “Supply chain issues continue, but our business is adapting.” [Agriculture, Forestry, Fishing & Hunting]

- “The escalation in costs for materials, fuel, labor, lodging and the like continues to negatively impact margins in an unsustainable direction.” [Construction]

- “Higher than normal employee attrition within our own company and at our suppliers, which is causing disruptions and delays.” [Finance & Insurance]

- “There is widespread fatigue across the organization as COVID-19 hospitalizations have plateaued, but in the face of yet another variant (omicron), the winter forecast is not positive. Although hospitalizations have eased, demand for services is up, as is the acuity of patients. Due to mainly logistical concerns, the supply chain remains turbulent and some supply shortages, including of Vacutainers, are hindering operations. Our organization is cautiously optimistic going into flu season.” [Health Care & Social Assistance]

- “Most upstream production materials are being pressured by constrained supply chains as well as domestic transportation challenges. Vendors are trying not to pass on expenses, but their margins are such that they will need to raise prices. While we have done a good job holding prices down, we will not be able to hold the vendors at bay. All (cost of goods) will be impacted.” [Information]

- “Activity continues to maintain a steady pace. Inventory levels and outages are persistent with our suppliers; however, starting to see some relief in the supply chain, but not below the critical point yet. Prices continue to be driven up, with shipping costs the largest driver due to inflated pressures on capacity and fuel costs.” [Other Services]

- “Electronic chip (shortage) is severely affecting deliveries from our supply base, thus impacting our ability to deliver to customers.” [Professional, Scientific & Technical Services]

- “Long lead times, transportation bottlenecks, delivery inconsistency and price increases continue to affect a range of products.” [Retail Trade]

- “We continue to experience supply chain disruptions across the nation and around the globe, resulting in raw material and subcomponent shortages, longer manufacturer lead times, transportation resource constraints, labor pool issues and significant price increases. Supply management continues to recommend pulling in demand, placing orders earlier than historical lead times for long lead-time materials, and qualifying secondary sources of supply (if applicable).” [Utilities]

- “Demand is good, but supply chain issues continue to get worse. Trucking availability is worsening. Labor shortages are causing issues. We could do much more business if we had more people and access to more products.” [Wholesale Trade]

I suspected we would get a downside miss in this report — the consensus was far too optimistic given omicron — and now we’re seeing downside in risk assets.