Forex Signals Brief for May 30: Risk Sentiment Is On Again, Despite Global Recession Fears

Last Week’s Market Wrap

Last week we witnessed the first contradiction to appear in economic reports which many economists were fearing. Central banks have been raising interest rates several times, with the Bank of England leading the way after delivering five rate hikes in a row since December. But, they have failed to stop prices from increasing, with CPI inflation reaching 9.1% in the UK, while the services PMI indicator posted a major slowdown, which is pointing to a possible recession.

With prices increasing and central banks hiking rates in a hectic manner, the consumer is being put in a tough spot. Retail sales showed a decline in New Zealand during Q1 of this year, which also reinforces this idea since the RBNZ started hiking rates the first among major central bank last October. The US Dollar continued the retreat for the second week as risk sentiment improved somewhat, sending stock markets higher in the second part of the week.

The Data Agenda This Week

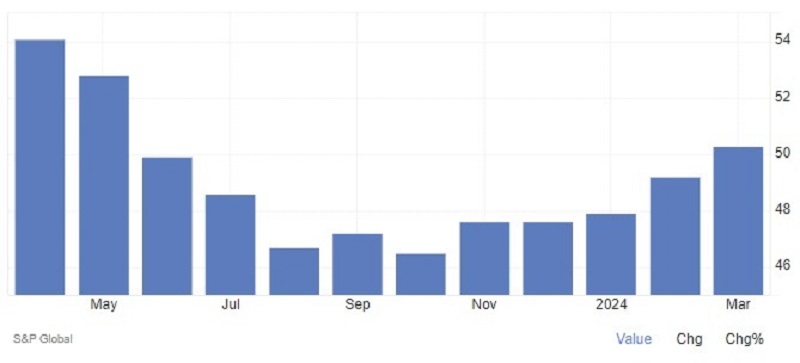

This week we have the Chinese and US manufacturing reports. Chinese manufacturing activity is expected to improve but still remain in contraction, as the effect of lockdowns continues. The GDP reports from Canada and Australia are expected to show slowdowns, but we might see a contraction as well, like the one we saw in the US during Q1. The Bank of Canada is expected to deliver another rate hike on Wednesday, this time by 50 bps.

Forex Signals Update

Last week we continued the positive run with our signals in the first half of the week, as the USD decline continued and we remained short on the USD. Although toward the end of the week, we had some difficulties as the forex market became less certain, which led to some whipsaws in most major pairs.

USD/JPY – Sell Signal

USD/JPY has been bullish for two years but in the last two months, it picked an incredible pace as it pushed above 131. Although, earlier this month this pair started retreating lower as the USD started to weaken and moving averages turned into resistance. We decided to turn short on this pair and sell retraces to the 20 SMA which has been the ultimate resistance lately.

USD/JPY – 240-minute chart

EUR/GBP – Buy Signal

EUR/GBP turned higher last week, as the Euro started increasing more than the GBP, but eventually, the buying pressure ended and this pair was slowly retreating lower. We decided to open a sell signal after the price formed a doji candlestick on the H1 chart at the 50 SMA (yellow), which acted as support for a while. We saw a bounce off that moving average and the price approached our TP target, but then this pair reversed lower suddenly, although the 200 SMA (purple) held as support.

S&p500 – Daily chart

Cryptocurrency Update

Cryptocurrencies turned quite bearish earlier this month, but in the last 2-3 weeks they have been consolidating in a tight range. We saw a small crash in BTC, but the price returned in side the range quickly, which suggests that both sides are uncertain and unwilling to push in either direction right now.

Bitcoin Testing the Bottom of the Range

BITCOIN resumed the decline earlier this month pushing below $30,000, although, the decline stalled and the price has been bouncing between $28,500 and $31,000. Sellers have pierced the bottom of the support level but there has been no close below it. Although the price is sticking to the bottom of the range for too long, which indicates selling pressure.

The support is still holding for now

Will Last Summer’s Low Hold for FTM/USD?

Fantom crypto was showing strong bullish pressure until the middle of January, when it retested the previous highs below $3.50. But eventually, the negative sentiment in the crypto market and the Wonderland controversy pulled this cryptocurrency down.

Then, two of the most prominent personnel left the fantom team, such as Andre Cronje who is a prolific developer and Anton Nell, a senior solutions architect weighed on FTM/USD further sending it below $1 at first and then to $0.25. Although Cronje might return to Fantom after some rumors we heard, which would be great news for FTM. The 20 daily SMA (gray) rejected the price on Monday, but we are seeing if the support from last summer at around $0.15 will hold.

FTM/USD – Daily chart