Unemployment Claims Keeping the Pressure on the USD

Most of the European session was quiet as traders tried to take it easy before the Easter bank holiday weekend starting tomorrow. There is still fear and as a result caution as well in the markets, but it seems like we will have to wait for Wall Street to see any major movements before the US jobs report on Friday.

The USD was mostly steady and didn’t see much activity, as major currencies also lacked interest for trading during the session. But, the decline resumed in the US session, as US unemployment claims came more than 20K above expectations for last week, while the previous week’s numbers were revised higher as well, showing that employment is feeling the pressure from higher interest rates.

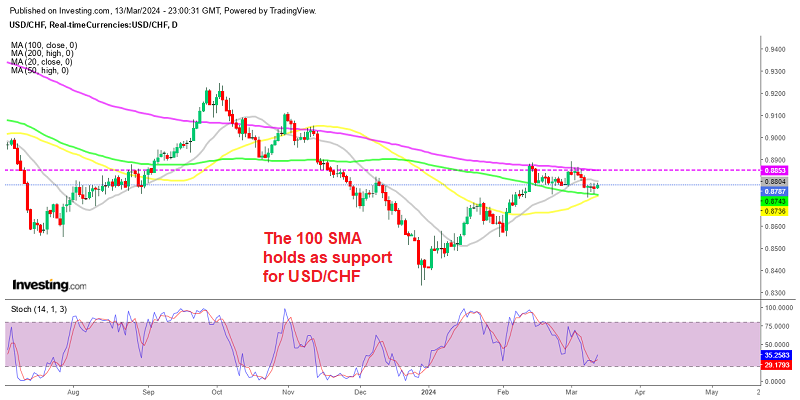

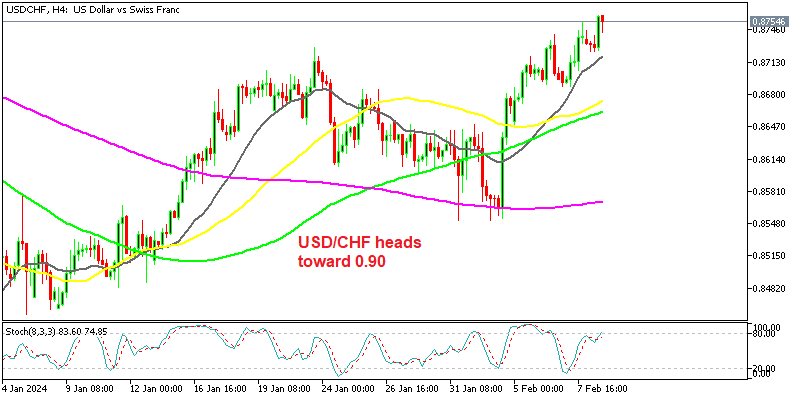

US stock indices opened with a bearish gap lower but reversed higher after the report and are making gains. Safe havens such as the JPY and GOLD were retreating earlier in the European session, while the CHF continued to push higher. We opened a sell EUR/CHF signal a while ago, so let’s see if the CHF will continue the bullish momentum after the higher unemployment claim.

US Initial Jobless Claims Report

- Initial jobless claims 228K vs 200 K estimate. Prior revise it to 246K from 198K

- 4 week moving average initial jobless claims 237.75K vs 242K (revised up from 198.25K)

- continuing claims 1.823M vs 1.699M estimate. Last week came in at 1.689M revised up to 1.817M

- 4-week moving average of continuing claims 1.804M vs 1.793M (revised up from 1.692M)

Goldman reported that there would not be surprised to see a spike in initial jobless claims due to seasonal adjustments. They warned that the claims could spike up to 240,000 after adjusting for the seasonals instituted last year (which they feel artificially lowered claims). It seems to have pushed through.

The chart above now adjusts for the new seasonals. Note how the lows from earlier this year were near 200K and have been trending higher.

The Labor department did say:

REVISION TO SEASONAL ADJUSTMENT FACTORS:

Beginning with the Unemployment Insurance (UI) Weekly Claims News Release issued Thursday, April 6, 2023, the methodology used to seasonally adjust the national initial claims and continued claims reflects a change in the estimation of the models. Seasonal adjustment factors can be either multiplicative or additive. A multiplicative seasonal effect is assumed to be proportional to the level of the series.

A large increase in the level of the series will be accompanied by a proportionally large seasonal effect. In contrast, an additive seasonal effect is assumed to be unaffected by the level of the series. In times of relative economic stability, a multiplicative adjustment is generally preferred over an additive adjustment. However, in the presence of a large level shift in a time series, multiplicative seasonal adjustment factors can result in systematic over- or under-adjustment of the series. In such cases, additive seasonal adjustment factors are preferred since they tend to track seasonal fluctuations more accurately in the series and lead to smaller revisions.

Prior to the pandemic, the unemployment insurance claims series used multiplicative models to seasonally adjust the claims. Starting with March 2020, Bureau of Labor Statistics (BLS) staff, who provide the seasonal adjustment factors, specified both of the UI claims series as additive. After the large effects of the pandemic on the UI series lessened, the seasonal adjustment models were once again specified as multiplicative models. Statistical tests show that the UI series should, in normal times, be estimated using multiplicative adjustments. While the pandemic period remains within the five-year revision period, the UI series will be treated as a hybrid adjustment.

The most volatile economic period of the pandemic, including the period running from March 2020 to June 2021, was not revised and will continue to be based on additive adjustments. Before and after these periods, both series are adjusted using multiplicative adjustments. For consistency, the published seasonal factors are presented as multiplicative with additive factors converted to implicit multiplicative factors and will not be subject to revision. Now that the pandemic impacts on the on the UI claims series are clearer, modifications have been made to the outlier sets in the seasonal adjustment models for both of the claims series.

This led to larger than usual revisions during many weeks over the last 5 years, however, these changes should provide a more accurate picture of claims levels and patterns for both initial and continued claims. For further questions on the seasonal adjustment methodology, please see the official release page for the UI claims seasonal adjustment factors or contact BLS directly through the Local Area Unemployment Statistics web contact form.