Gold Price Shows Weekly Gain Amid Optimism Ahead of US Employment Report

The price of GOLD (XAU/USD) is set to record its first weekly gain in four weeks, as market sentiment remains cautiously optimistic heading into the key US employment report for May. This recent surge in gold prices can be attributed to reduced hawkish expectations from the Federal Reserve (Fed) and hopes of averting a potential US default. Furthermore, the rise in equity markets, particularly in the technology sector, coupled with lower bond yields, has added strength to the upward movement of gold prices. Additionally, the positive outlook on China’s economic recovery, as a significant consumer of gold, has further boosted the XAU/USD’s upside potential.

The release of today’s US employment report holds significant importance, as any surprises in the headline figures are expected to have a notable impact. Nonfarm Payrolls (NFP) are projected to decrease to 190,000 from the previous 253,000, while the Unemployment Rate is anticipated to rise to 3.5% from 3.4%. Additionally, market participants will closely monitor the US Senate’s passage of the debt-ceiling bill to avoid default concerns, as well as the final round of talks by the Fed ahead of the pre-Federal Open Market Committee (FOMC) blackout period for policymakers.

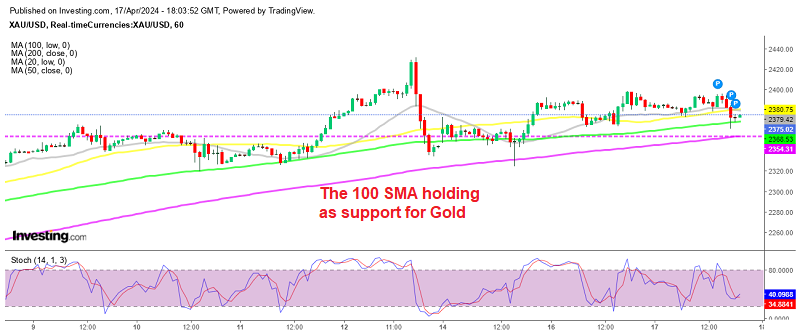

Key levels to watch for the GOLD Price are highlighted by our Technical Confluence Indicator. The price has surpassed the crucial confluence level at $1,968, which includes the 50-hour moving average, Fibonacci 61.8% on the one-week timeframe, and Fibonacci 23.6% on the one-month timeframe. Furthermore, the XAU/USD remains above the Fibonacci 38.2% on the one-day timeframe and the middle band of the Bollinger on the hourly chart, around the $1,972 resistance level, indicating a positive sentiment among buyers.

The previous resistance level now acts as immediate support, with the convergence of the Pivot Point one-week R1 and Fibonacci 23.6% on the one-day timeframe. The GOLD Price has the potential to approach the $1,992 resistance level, which includes the 50-day moving average and 200-hour moving average on the four-hour chart. In case buyers sustain momentum beyond $1,992, the $2,000 psychological level may serve as the final defense for the Gold bears.

The previous resistance level now acts as immediate support, with the convergence of the Pivot Point one-week R1 and Fibonacci 23.6% on the one-day timeframe. The GOLD Price has the potential to approach the $1,992 resistance level, which includes the 50-day moving average and 200-hour moving average on the four-hour chart. In case buyers sustain momentum beyond $1,992, the $2,000 psychological level may serve as the final defense for the Gold bears.