March 9th Morning Brief – ECB Interest Rate In Focus

Good morning, everyone. It's been such a pleasant morning as the weather here is wonderful and we got the loveliest of morning gifts since our Nikkei Signal hit take profit overnight in the early Asian session. The market moved exactly as we predicted in "A Bearish Trade Setup in Nikkei". Additionally, the ADP- Employment change helped us achieve our forex signal goals.

One of the most important economic events on our calendar takes place today. The ECB (European Central Bank) is making a decision on monetary policy. Later on in the evening, President Mario Draghi will have a press conference as well.

Major Economic Events Today

EUR

- ECOFIN Meetings (Anytime)

- Minimum Bid Rate (12:45)

- ECB Press Conference (13:30)

CAD

- NHPI m/m (13:30)

USD

- Unemployment Claims (13:30)

- Import Prices m/m (13:30)

- 30-y Bond Auction (13:30)

JPY

- BSI Manufacturing Index (23:50)

What to Expect From the ECB?

Minimum Bid Rate

Let's get it straight; I'm not expecting any change in the Minimum Bid Rate. Investors increased their bets on the interest rate hike sentiments from the ECB as things were getting better in the Eurozone. Inflation figures are slightly better and the unemployment rate is also up. Still, Mario Draghi has never shown confidence in the rate hikes, nor has he mentioned them.

Impact: The Euro is likely to get weaker if the ECB keeps the minimum bid rate unchanged at 0.00%.

ECB Press Conference

I'm more interested in listening to the insights of the ECB President, Mario Draghi. He is likely to share information about his next move and when it's likely to happen. You may recall their massive quantitative easing program where they were inserting a large quantity of money by open market operations. I'm sure they understood that the misleading increase in inflation was due to boosted energy prices. Overall, Draghi may sound dovish in the press conference later today at 13:30 (GMT).

EUR/USD, the Most Focused Currency Pair Today

It is now the 4th consecutive trading day that we have seen the EUR/USD pair maintain such a bearish momentum. It has dropped more than 100 pips in the current week. Let's recall the 6th of March Morning Brief where we shared that the U.S Dollar is likely to stay stronger because of the Fed Rate Hike sentiment. Yesterday, investors increased their bets on it after the release of a phenomenal ADP- Employment report.

Technical Outlook

Looking at the chart, it's clear that the sellers are taking more control of the market. EUR/USD has broken the significant double bottom support level of $1.05600, which has now been converted into a resistance. The RSI is oversold (near 30) and we can see a Doji and Hammer candlestick formation in the 1 – hour chart. It's signaling us to hold on and wait for a slight pullback before entering a further selling position.

Trading Signal: It's in our best interested to wait for Mario Draghi to provide more clues about trends in the market.

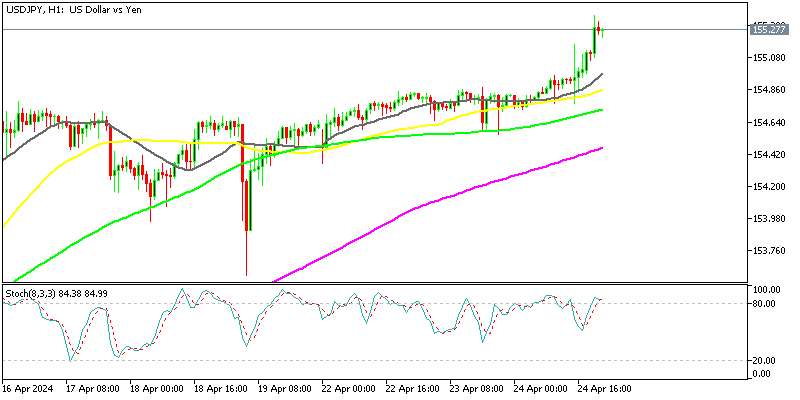

USD/JPY, the Safe Haven Currency Pair

Yesterday, the USD/JPY had a massive volatility after the U.S private sector labor market figures increased the odds of a positive NFP on Friday. Today, the ECB is definitely going to impact the U.S Dollar index, so USD/JPY will also feel a wave of impact coming from actual decisions.

Technical Outlook

At the moment, the USD/JPY is holding below a double top resistance level of $114.750 in the 1- hour time frame. It's definitely suggesting that the buyers are exhausted and we may see some buyers coming out of the market before major news breaks ahead in this week. The pair has already completed a 38.2% Fibonacci retracement at $114.300. Below this level of 114.300, I can see more room for selling.

Forex Signal: I would recommend to have a buy position above $114.220, with a stop loss below $113.90 and a take profit at $114.850.