Trading At Par: Key Levels For The USD/CHF

It is a relatively lazy Monday morning across the majors, with range bound markets dominating the U.S. session. The USD has performed moderately well, posting gains against the Euro, Japanese yen and Swiss franc. With no big economic releases on the calendar for today, a rotational trading strategy will give us the best chance at taking a few pips out of the market.

USD/CHF Technicals

The dollar has posted solid gains against the franc since the early portion of September. Currently, the USD and CHF are trading at par.

USD/CHF, Daily Chart

USD/CHF, Daily Chart

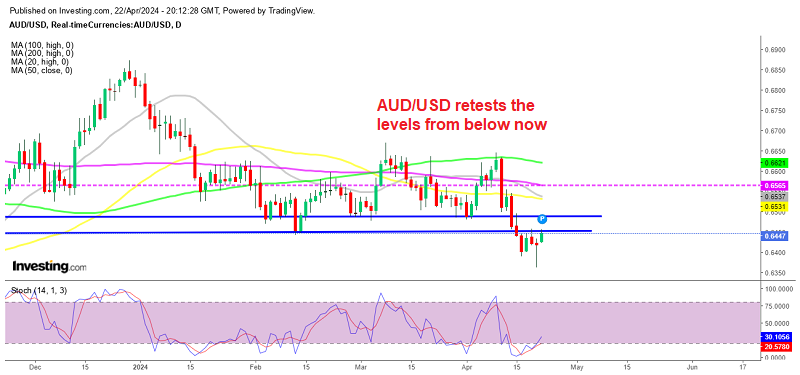

The key levels for this market moving forward into the trading week:

Support(1): 62% yearly retracement, .9986

Support(2): 20 Day EMA, .9895

Support(3): Bollinger MP, .9872

Resistance(1): Double top, 1.0037

Resistance(2): Psyche level, 1.0050

Resistance(3): 78% yearly retracement, 1.0134

Bottom Line: Until the market deviates from the 1.0000 area, the USD/CHF is likely to remain in a rotational phase. For the remainder of today’s session, I will be fading the extremes. Longs from .9986 with a stop below .9975 produce a 1:1 R/R for 12 pips on a return to par.

Conversely, 1:1 R/R shorts from the double top of 1.0037 with a stop above 1.0050 yields a 14 pip profit on a regression to value.

For now, I am noncommittal to this market. Premium locations to the bull and bear are a ways off. But, trading rotation successfully is an affordable way to profit from muted price action.

Stay tuned to FX Leaders for more trading signals and analysis as the U.S. session unfolds.

++8_18_2017+-+11_6_2017.jpg) USD/CHF, Daily Chart

USD/CHF, Daily Chart