An Interesting Start To 2018: USD/CAD Recap

It has certainly been a typical Monday forex trading session. Marked by tame action across the majors, the largest move of the day has been in the EUR/USD. In the U.S. overnight preview, I will outline a few of the key levels and elements to watch for facing the EUR/USD. The economic calendar is relatively quiet, but that is soon to change over the coming 24 hours.

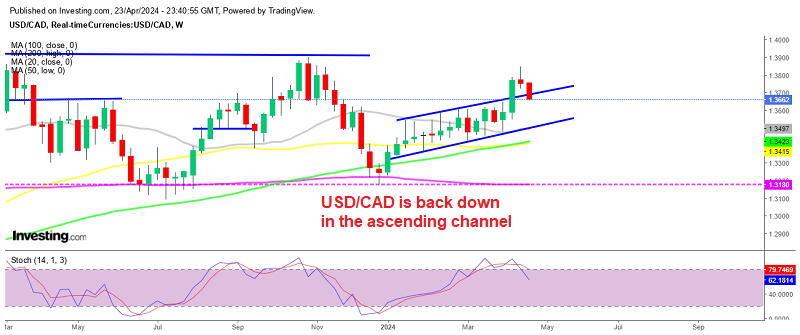

USD/CAD Technicals

In a live market update from last Friday, I issued a long trade recommendation for the USD/CAD. After taking some considerable early heat, the trade has rebounded to produce a nice upside move of 42 pips.

++10_8_2017+-+1_8_2018AAA.jpg)

From looking at the daily timeframe, it appears that the Loonie is settling into a pronounced “L” formation. Today’s range has traded firmly inside of Friday’s, with the defined macro support level proving valid.

Here are the key areas to watch for the remainder of the U.S. session:

- Support(1): 62% Sept./Dec. Retracement, 1.2388

- Support(2): Swing low, 1.2355

- Resistance(1): 50% Sept./Dec. Retracement, 1.2490

Bottom Line: If you took the long (1.2408) from last week’s recommendation, then this trade has been a rollercoaster ride. A nice upside was available earlier in the session, but price is currently in the green by a modest 15 pips.

At this point, there is nothing wrong with taking profits if you haven’t already done so. At the very least, it is time to move the stop loss beneath the intrasession low at 1.2377. Remember, trade smart and for tomorrow!