Booked Profit on Our NZD/USD Signal. Rinse and Repeat?

How to Predict the End of a Pullback/Retrace

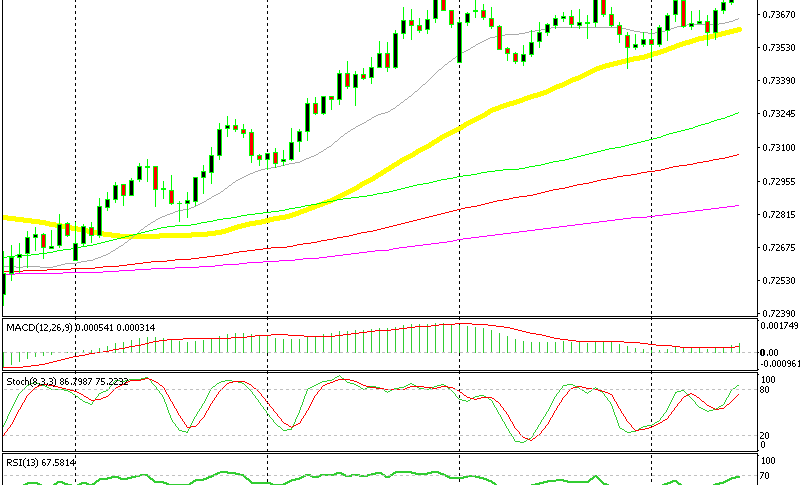

Yesterday we opened a forex signal in NZD/USD. We went long on this pair when it was retracing lower in the evening. Usually, we wait for a confirmation that the retrace is over before pulling a forex trade. Such confirmation might be a pin or a doji which signal a reverse, meaning that the trend is about to resume.

Yesterday we didn’t get such a confirmation. Although, there are other technical indicators which signal the end of the retrace. The indicators we used yesterday were the 50 SMA (yellow) and the stochastic.

Although the hourly candlestick looked pretty bearish when we opened our buy signal, we decided to go long because the price had reached the 50 SMA. This moving average had been providing support and resistance. The stochastic indicator was oversold too, so we trusted that chart setup.

The stochastic and the 50 SMA were enough for us to make our mind up

Which Pair to Choose

We could have gone long on AUD/USD instead of NZD/USD yesterday. These pairs behave in similar fashion together with USD/CAD. So, why did we choose to trade NZD/USD?

We chose this pair because the trend here has been steeper than in AUD/USD, which means that the odds of winning are higher for buyers. It proved to be the right decision. Had we bought AUD/USD, the trade would still be on since the price is around the opening level. Now we have a winning signal in NZD/USD, so we can concentrate on other trades.

NZD/USD continues to be on a bullish trend, therefore I’m thinking about buying it again. But, We will wait for another retrace lower before going in, perhaps at the 50 SMA again.