US Session Forex Brief, June 4 – RBA Cuts Rates, Inflation Dives in Europe, but the USD Weakness Continues

This morning the Reserve Bank of Australia (RBA) cut interest rates by 25 basis points to 1.25%. They were expected to cut them in the last meeting but they didn’t and instead, slashed them today which was also anticipated by market participants, given the increasing trade conflict, the weakening Chinese and Australian economy as well as the fact that the Reserve bank of New Zealand cut interest rates last month. But as it is often the case, when markets anticipate a rate cut, the price action following it is pretty dull, like we saw this morning. The RBA would have liked the AUD to dive lower as chairman Lowe said later, but AUD/USD didn’t mind much as the USD weakness of the last two days is still prevalent in the markets.

European Session

- Italian Monthly Unemployment Rate – The unemployment rate has been on a declining trend in Italy although it remains at elevated levels. In February we saw a jump to 10.5% and another jump to 10.7% in March. Although, March was revised lower to 10.5% again. We saw another decline to 10.2% in April, but in May the unemployment rate was expected to increase to 10.3% again. Although it beat expectations today remaining at 10.2%.

- UK Construction PMI – The British economy has slowed down as considerably as the rest of the globe and the construction sector even dived into contraction in February and March. Although, it came back into contraction in April as the PMI indicator moved to 50.5 points. In May, this indicator was expected to tick higher to 50.6 points but it dived to 48.6 points, which means deep contraction for this sector.

- Eurozone CPI Inflation Report and Unemployment Rate– Inflation jumped higher in April but that was due to the Easter holiday effect. Inflation has cooled off more than anticipated with headline CPI falling to 1.2% against 1.4% expected. Core CPI also missed expectations of 1.0% and declined to 0.8% in May from 1.3% in April. At least the unemployment rate ticked lower to 7.6% from 7.7% previously .

- China Playing Good Cop – China’s commerce ministry commented earlier. They said that trade differences with US should be resolved via dialogue, negotiations. Trade talks should be based on mutual respect. They hoped that the US would stop its wrongdoings and meet them halfway.

- Mexico Playing Good Cop – Mexico’s Foreign Minister, Marcelo Ebrard said earlier today that Mexico expects common ground in talks with US over tariffs and immigration. He is to meet with US’s Lighthizer later today. Mexico is finishing preparatory work for US talks currently. Marcelo sees 80% odds of negotiating resolution for Mexico, US.

US Session

- US Prelim Factory Orders – Factory orders have been pretty weak in recent months, but in March we saw a major jump by 1.9% as we saw last month. Although that was revised lower today to 1.3%. For April, we were expecting to see a 1.0% increase but they beat expectations, falling by 0.8% which is still pretty bad.

- FED’s Powell Speaking – FED Chairman Jerome Powell was speaking a while ago, saying that the FED will ‘act as appropriate’ to sustain expansion. Here are some main comments: Fed ‘closely monitoring’ impact of trade developments, the economy growing, unemployment low, inflation stable. The FED does take seriously that persistent low inflation unhinges inflation expectations. We do not know how or when trade issues will be resolved. Much higher likelihood that rates will fall, effectively lower bound in a downturn. Crisis-era tools worked and are likely to be needed again. ‘Dot plot’ has distracted attention from how Fed will react to unexpected events.

- Mexico Still Playing Good Cop – The Mexican President Lopez-Obrador took the center stage a while ago saying that he’s optimistic, and that he believes there will be a deal before June 10. There are signs that US officials want to get a deal. Talks with the US are going well. We must deal with the causes of migration, aside from applying migration laws, we must deal with the causes of migration. The funds required to deal with the causes are manageable. The US was created on the back of migration from many countries. Mexico is willing to accept proposals of the US on migration. If there is not a deal tomorrow on migration then it will be the day after. Migration is key topic of Wednesday meeting.

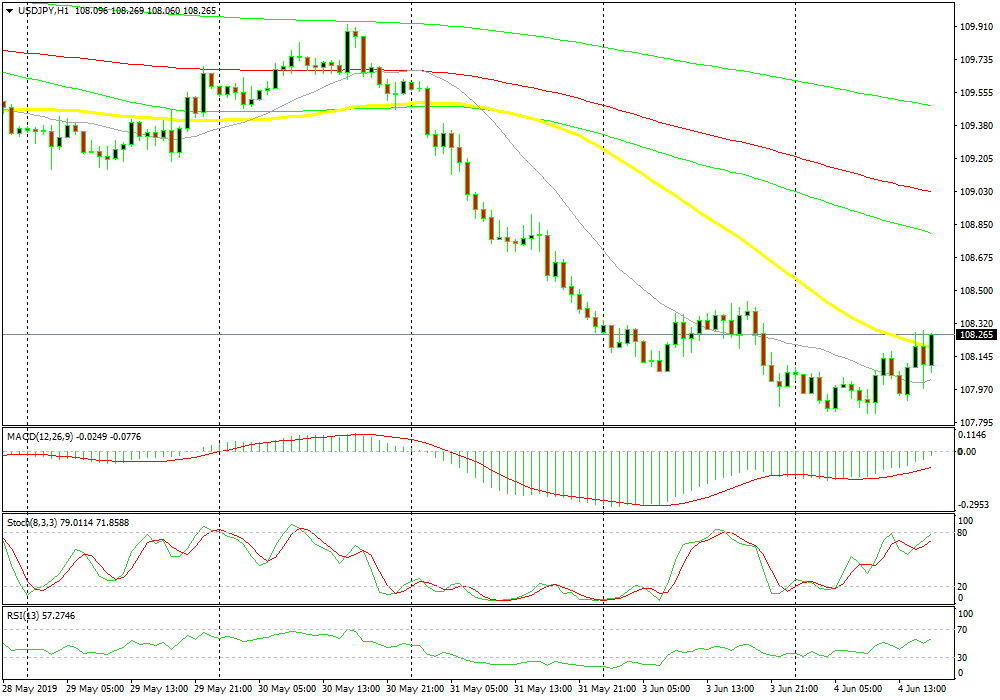

Bearish USD/JPY

- The main trend remains bearish

- The price is trading at the 50 SMA

- Fundamentals are still bearish for this pair

The area around 108.20-30 has been tought to overcome

USD/JPY has turned pretty bearish in recent weeks as trade tensions escalate and the global economy weakens. The JPY has strengthened as a safe haven, together with Gold. USD/JPY broke below 108 yesterday but today it has been retracing higher during the European session. But, the buyers are having difficulties at the 50 SMA (yellow) and stochastic is now overbought on the H1 chart, which looks like a good chance to go short on this pair since the sentiment remains pretty negative.

In Conclusion

The USD is still at a weak moment and the factory orders report which was released a while ago didn’t help as it showed a decline in April. Mexico and China are trying to cal the situation down with some positive comments and the rick situation has improved a bit, but I expect tougher times to come.