Forex Signals US Session Brief, July 8 – Are Germany and the Eurozone Falling Into Recession?

The economy of the Eurozone has been weakening since summer last year, as the trade war started having its effect on global trade and eventually caught up with the major economies of the globe. The economic data has shown a considerable slowdown in the Eurozone economy and the manufacturing and industrial sectors are in a really soft spot, contracting in Germany, while the rest of the sectors are not doing much better either. The investor sentiment is also deteriorating and this morning we saw a further decline into negative territory for the German Sentix investor sentiment. That’s not the worst yet; the surveying firm Sentix said that Germany might actually head into recession. The Italian economy fell in recession during Q2 of 2018; so is it time for Germany to do the same now? If it does, then the economy of the Eurozone will likely fall in recession as well. The ECB said today that they might restart the QE program, which means that they might be preparing for this scenario, but let’s see how the data will be in the coming weeks.

Across the price action has been pretty strange in the last couple of months in financial markets. The global economy has been weakening for about a year now with most of major economies in great difficulty, but the US economy was holding up well, despite the global slowdown. Although, in the last two months, the economic data has shown that the US economy was as resilient as the FED had thought since they have been hiking rates quite fast. We have seen some really weak data accumulate in recent months and now the FED is thinking about cutting interest rates, so Donald Trump was right to get upset with the FED for tightening the monetary policy too quickly. As a result, in the last two months, traders have been uncertain where to invest, after being bullish on the USD for about a year. But the G20 summit improved the sentiment for the USD and it seems like the USD buyers are returning now, as the USD continues to crawl higher today, following a bullish week last week.

The European Session

- German Sentix investor Confidence – The investor confidence has been deteriorating in Germany and in the Eurozone for more than a year, but we saw a short-lived reversal in recent months and a climb into the positive territory. But last month, the Sentix investor confidence turned negative again. This month, it was expected to reverse and turn positive, but it missed expectations, coming at -5.8 points. The headline reading shows that confidence among investors is at the weakest level since November 2014. The surveying firm Sentix highlights that a German recession is looming and “looks unavoidable”, which is the main worry for investors.

- German Industrial Production – The industrial production was pretty volatile in 2018, although towards the end of the year and in January this year the production kept declining as the global economy slowed down further. In February and March, the industrial production picked up but that seemed pretty weak and in April the production fell by 1.9%, which was revised lower to -2.0% today. For May, industrial production was expected to show an increase of 0.4% and it increased indeed, but by 0.3%, as today’s report showed.

- ECB Coeure Sounding Dovish on the Economy – The ECB governing council member, Benoit Coeure, was speaking a while ago that the central bank could restart the Quantitative Easing programme if needed. He added that the ECB needs accommodative policy now more than ever before. These are pretty dovish comments after the ECB pointed to more rate cuts in the near future.

The US Session

- Canadian Building Permits and housing Starts – Building permits have been pretty strong last year in Canada, but they turned pretty soft in the Q1 of this year. In January and February, they declined by 5.5% and 5.7% respectively and in March the increase was really weak. Although, in April, they jumped 14.7% higher beating expectations of 0.9% as last month’s report showed. There are no expectations for May, so let’s see if this sector will keep the pace of April. Housing starts also posted a nice jump of 239k in April, but fell back to 202k in May. Today’s report is expected to show another increase, this time to 209k.

- US Consumer Credit – The consumer credit used to hold within a range between $15 billion and $17 billion in the US. But in March it fell to just $10.3 billion. Although, we saw a reversal in April and a jump to $17.5 billion as the report released last month showed. Today’s report is expected to show a cool-off and decline to $15.2 billion, which would still be within the normal range.

Trades in Sight

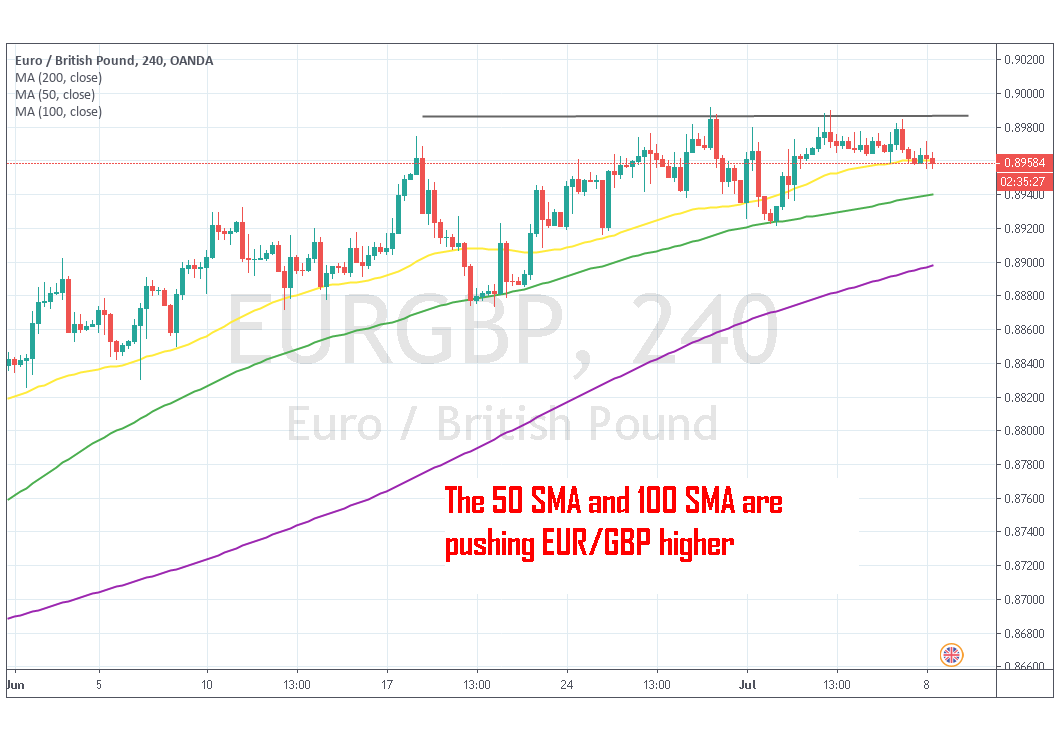

Bullish EUR/GBP

- The trend has been bullish for a long time

- The retrace lower is becoming complete on the H4 chart

- The 100 SMA should provide support lower if the 50 SMA breaks

The 50 SMA and the 100 SMA have been providing support for a long time for EUR/GBP

EUR/GBP has been bullish for a long time, since it became obvious that Theresa May`s Brexit deal wouldn’t pass the British Parliament. We saw a pullback lower after the European Central Bank turned increasingly dovish in the last meeting, but the uptrend resumed again and the buyers pushed higher. During this time, the 50 SMA (yellow) and the 100 SMA (green) have done a good job providing support and pushing this pair higher. Right now the price is back at the 50 SMA which is already offering some support, but in case the 50 SMA goes, the 100 SMA will take its place. So, we are looking to go long on this pair.

In Conclusion

The USD seems to have found its feet again after turning bullish last week and pushing higher today. Although, the buyers don’t seem as confident. EUR/USD is still slipping lower and as the Eurozone economy continues to weaken, I suppose the support at 1.11 will go soon. The ECB surely thinks so.