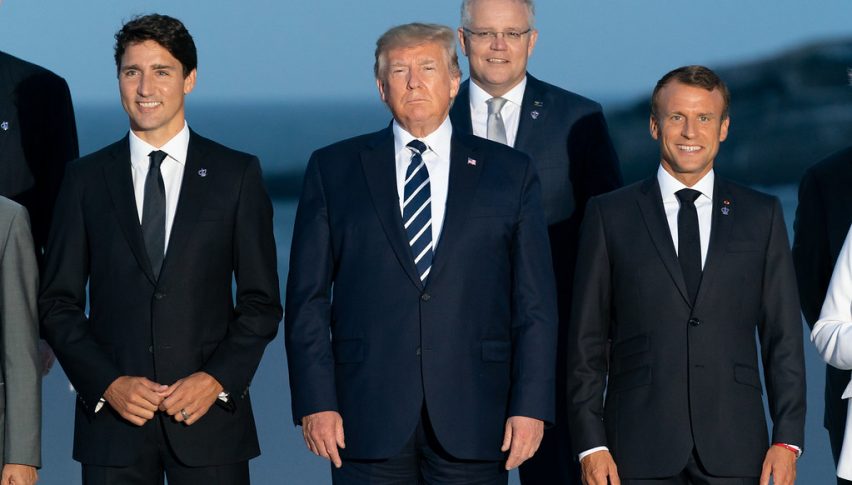

Forex Signals US Session Brief, August 27 – Markets Quiet After G7, GBP Keeps Climbing on Brexit Rumours

During the last few days we have seen the volatility increase in financial markets as the G7 summit took place. There are quite a few global issues which have been haunting markets this year and traders were hopping for some solutions from this summit. Last Friday, we saw a last minute surge in safe havens and a crash in risk assets such as commodity Dollars after Trump’s comments for an increase in tariffs on China. That hurt the sentiment and we saw a bearish gap in risk assets yesterday when the Asian session started, while safe havens opened with a bullish gap higher.

Although, the situation improved yesterday after Donald Trump softened the tones and left it to China to decide whether they want to escalate the trade war further or come to the negotiation table. Today, markets are much more quiet, especially after the G7 summit came to an end.

The GBP turned bullish last week after bouncing off the big round level at 1.20 which seems to have formed a support zone around it. yesterday we saw a retrace lower in GBP pairs, but the retrace ended today and GBP/USD climbed around 100 pips in the European session. The reason for this were rumours for alternatives to the Irish backstop, as well as about making no-deal Brexit illegal in the UK as the opposition parties suggested.

The European Session

- German Q2 GDP – The German economy has weakened considerably in recent months. Manufacturing is in deep contraction which seems to be getting deeper wjhile industrial production has been declining for more than a year. Economists predict a recession in Germany and today’s final GDP reading showed that the economy had contracted by 0.1% in Q2. If it contracts again in Q3 then we will have a recession.

- Iran Is Standing Its Ground Firmly – The Iranian president Rouhani made some comments early this morning saying that if US does not lift sanctions, there will be no change to the status quo. Tehran has never wanted nuclear weapons. Iranian foreign affairs minister, Javad Zarif also chipped in later. He said that a meeting between Trump and Rouhani is unimaginable and there will be no bilateral talks with the US.

- Brexit Talk – Labour’s Starmer said this morning that legislation must be in place to stop a no-deal Brexit. The Labour Party and other opposition parties are trying to bring a law that would prevent a no-deal Brexit scenario. That helped the GBP, as well as Prime Minister Johnson’s comments after the G7 ended today that an alternative solution to the irish backstop could be found. UK PM spokeswoman, Alison Donnelly said that the UK wants to discuss options to replace backstop with the EU and Johnson to speak with Juncker later today.

- Politics in Italy – The Five Star party (Cinque Stelle) and Democratic Party (PD) were close to be forming a new alliance over the weekend but it looks like they’re not able to agree on who should lead the government with Five Star insisting that Conte be the one to head the helm once again.

The US Session

- ECB’s de Guindos Speaking About Monetary Policy – The ECB vice president, Luis de Guindos said a while ago that the monetary policy is data dependent, not market dependent. It is important to get the market view about where the economy stands. Also important to get the view of where it is heading. Indications from market expectations cannot replace our policy judgment and expectations that are priced in financial markets need to be taken with a pinch of salt.

- US Consumer Confidence – The US consumer confidence posted some nice numbers last month,coming at 135.7 points which was revised higher today to 135.8 points. Although expectations were that the confidence among the US consumer would be hurt this month after the escalation of the trade war. But, U.S. August consumer confidence came in at 135.1 points, down from 135.8 in July. The figure outperformed expectations of 129.0. In addition, the Richmond FED Manufacturing Index for August came in at +1, over estimates of -2. The present situation came at 177.1 points against 170.9 prior which is the highest since 2000.

- Dudley Is Against Trump – Former New York Fed President Dudley said a while ago that the FED should stop enabling Trump. Every rate cut is a green light to escalate the trade war. Trump’s ongoing attacks on Powell and on the institution have made that untenable. Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks – including the risk of losing the next election.

Trades in Sight

Bullish USD/CAD Again

- The main trend is bullish

- The pullback lower is complete on the H4 chart

- The 100 SMA provided support

The 100 SMA stopped the pullback in USD/CAD

USD/CAD turned bullish in the middle of July after consolidating above 1.30 for some time. During the last two weeks of last month this pair climbed more than 300 pips higher as Crude Oil prices slipped lower, but during this month, this pair has been trading in a range again. Yesterday we saw a retrace lower in this pair, but the 100 SMA (red) provided solid support on the H4 time-frame. the stochastic indicator became oversold and the price formed a couple of doji/hammer candlesticks which are a reversing signal. Now this pair has turned pretty bullish again.

In Conclusion

The G7 summit is over now and the volatility has declined today. Although the risk mode seems to have switched off again, with commodity dollars slipping lower whole safe havens are crawling higher. The GBP is also climbing today but that’s due to the Brexit rumours, so excuse the GBP from your normal trading.