EURGBP Resumes Downtrend Despite Higher Eurozone GDP

Yesterday we saw a large bearish candlestick in EURGBP, as it closed the day 50 pips lower from the highs, resuming the larger bearish trend

Yesterday we saw a large bearish candlestick in EURGBP, as it closed the day 50 pips lower from the highs, resuming the larger bearish trend. The price pierced above the 50 daily SMA as the GBP tumbled in the European session, but then the bearish reversal took place, with the GBP turning higher, following comments from the new UK chancellor.

In the first quarter, the currency pair held steady above 0.85, which acted as a key support level. However, in the second quarter, the moving averages began to push EUR/GBP lower, with several attempts to rally reversing course and eventually breaking below the support in June. This came after a period of downward movement in the pair.

EUR/GBP Chart Daily – The 50 SMA Rejects Again

In July, the price continued to decline after failing to surpass the 50-day Simple Moving Average (SMA). This failure highlighted a lack of bullish momentum, leading to a further decline that briefly tested the 0.84 level. Recently, the 50-day SMA (yellow) was retested, but selling pressure remained dominant. Today’s economic reports included Eurozone GDP data, along with updates from several European countries, which may influence future price movements.

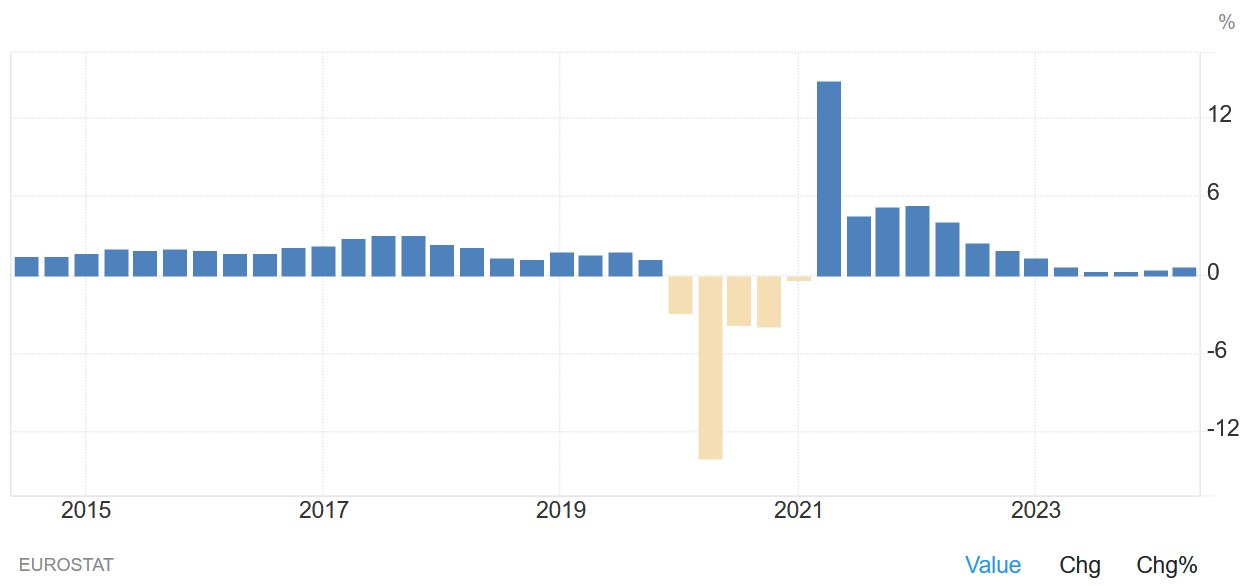

Eurozone Q2 GDP Prelim Flash GDP

- Eurozone Flash Q2 GDP Y/Y 0.6% vs. 0.5% expected and 0.4% prior.

- Eurozone Flash Q2 GDP Q/Q 0.3% vs. 0.2% expected and 0.3% prior.

In the second quarter of 2024, Ireland experienced the highest growth among EU member states with available data, posting a 1.2% increase. Lithuania and Spain followed, with growth rates of 0.9% and 0.8%, respectively. Conversely, Hungary saw a decline of 0.2%, Sweden decreased by 0.8%, and Latvia faced a significant drop of 1.1%. On a year-over-year basis, eight countries showed positive growth, while three reported declines.

The recent PMI data indicate that the Eurozone economy expanded in the second quarter, which is a positive sign. Looking ahead, the European Central Bank’s planned rate cuts in the coming quarters could boost confidence and stimulate further economic growth.

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account