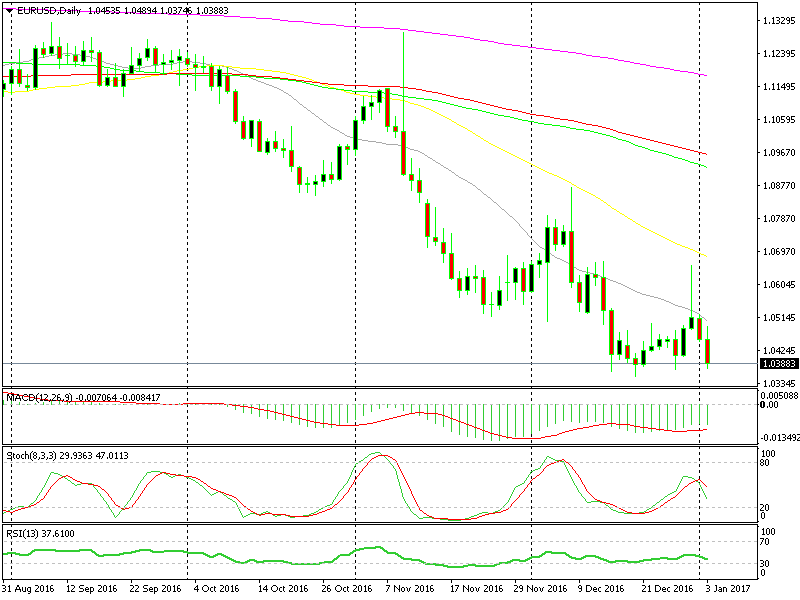

On Friday, we posted a market update about the recent Euro surge. As you can see form the EUR/USD chart below, this forex pair surged for nearly 300 pips last week, which brought up questions about the 2 month USD uptrend. Was this just an overdue retrace or was it a trend reversal?

A 300 pip pullback is considerable, so a trend reversal was still on the cards, but not considerable enough to be considered a reverse just yet. The 50 SMA in yellow had to be broken and the stochastic indicator has to reach overbought levels on the daily chart with the price pushing higher up so a reverse can take shape.

However, that didn't happen. As you can see, stochastic was a few yards short of reaching the overbought area, the price never touched the 50 SMA in yellow, let alone break above it, and the price couldn't even close above the 20 SMA in grey. To me, that´s not a trend reversal and the forex textbooks agree.

1.0350 here we come

1.0350 here we come

Now, this forex pair has given up almost all of its gains and is back below 1.04. This is the fourth time the price is threatening the 1.0350 support level and we know that the more a pair bangs its head against a level, the quicker that level is bound to be broken. So, fourth time a charm?

Perhaps this is the time for EUR/USD sellers to deliver the final blow. If this support level goes, then parity is in sight. In fact, during December I've heard a few big names in the forex industry calling for EUR/USD parity in January this year. Seems doable, but 4 cents are still a long way to go.

Similarly to USD/JPY, I´d prefer to open a long term sell forex signal when the price retests the 1.0350 level after being broken. With the price action we have seen in the last 3 days, the break is still on the cards today. Let´s wait and see what US traders might bring to the market after they have finished their morning coffee.