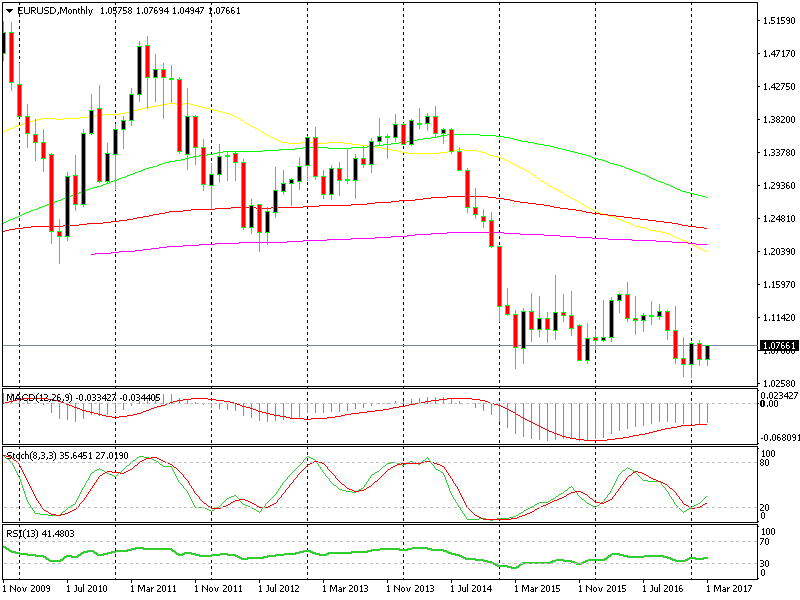

Watch the Euro Take Off – Is This the Big Turnaround?

We have been talking about a possible Euro reversal pretty soon, I mean a big one. The Euro has been in a steep downtrend for about 3 years, so it´s been a bit easy for us, I mean relatively, because this business is never easy.

But, in the last few months, the pieces have been coming together for a reversal, or at least a substantial retrace. The first level which springs in mind is 1.15. We have to overcome 1.08, 1.10 and 1.12 first, but that´s the target for the retrace.

The top of the range is not too far

The top of the range is not too far

If this is to turn into a real reverse, then 1.20 here we come. I´m taking this seriously now because the ECB (European Central Bank) has increased the hawkish rhetoric. First, it was Mario Draghi who acknowledged the improvement of the Eurozone economy and inflation, now we are seeing other board members hinting a rate hike.

Only a while ago, Nowotny said that an interest rate hike is coming and that the ECB could raise the deposit rate before the refinancing rate. This is a pretty hawkish comment (although we have to wait and see if it´s really how it sounds) and these sort of comments have been getting too frequent.

We still have the French and German elections to go, starting in a few months, but if the pro-EU parties cement their led in the polls then the forex market would lean on the Euro long before the real elections take place, because that´s what the market does.

The monthly forex chart surely points up and there´s plenty of room to run, so both technical analysis and fundamental analysis are falling in line. We still have to find the right time and the right spot to buy.