US Session Forex Brief, Apr 26 – US GDP Jumps, the Dollar Falls

This week the US Dollar has been enjoying the good times as the bullish reversal which started last Thursday after the confirmation that the European manufacturing sector is in deep contraction and the impressive US retail sales that same day. The USD has been pretty bullish all week, making new highs against most major currencies. Although, in the last few sessions the price action has been really quiet as traders were awaiting the US GDP report which was released a while ago.

Stock markets have also been bullish in the last few weeks although yesterday and during the Asian session today, we saw a pullback. But the pullback ended today and they are resuming the bullish trend now. Not Bitcoin though; Bitcoin lost $500 early in the morning today and it finally broke the 200 SMA on the daily chart which turned into support this week after providing resistance during the previous few weeks. There was some news overnight which my Aussie colleague Rowan covered about the loss of a number of Bitcoin coins that were never recovered. That undermines the safety of digital currencies, so it is bad news for the new industry.

The US GDP report was released a while ago and at first glance, it looked quite impressive as the US economy grew by 3.2% in Q1 of this year against 2.2% expected. But, the details were mixed, with inventories and trade helping boost the GDP. These are temporary factors, likely to reverse in Q2, so the Buck went from bullish to bearish pretty quickly. Inflation was weaker as well, as the GDP Price Index showed, so no pressure for the FED to hike interest rates.

European Session

- UK CBI Industrial Order Expectations – The CBI index turned negative in September and October last year, but it came back into positive territory and has been positive since then, apart from January when it dipped to -1 points. The CBI indicator was expected to increase from 1 point in March to 3 points this month, but it turned negative again, declining by three points.

- UK High Street Lending – High street lending has been holding around 39k-40k new mortgages a month for about a year, although we saw a decline to 35.3k in February as last month’s report showed. But that was revised higher today to 39.2 range while th number for March came at 40k exactly, beating expectations of 38.7k. So, back in the range for mortgages in Britain.

- ECB’s Olli Rehn Sounding Dovish – European Central Bank’s Rehn was speaking to Kauppalehti in an interview earlier on saying that some governing council members see rates low for a longer period. Some ECB governing council members think that keeping rates at current low levels into next year could be warranted. In this environment of economic uncertainty and weaker growth, there are grounds for continuing with very stimulating monetary policy. The big question now is ‘whether the European economy is experiencing a short and temporary phase of slower growth or a longer phase’. He also added later that investors may be doubting the effectiveness of central bank’s policy. Low inflation expectations reflect investors’ misgivings about ECB’s own policy. Long-lasting slow inflation may have lowered inflation expectations durably. Markets may find that monetary policy measures, under the current circumstances, are not effective enough to accelerate inflation.

- SNB’s Jordan Speaking – Chairman of the Swiss National Bank Jordan was speaking this morning. He said that rates will eventually turn positive again, but can’t say when. Future rate increases depend on inflation, FX developments but for now, negative rates remain necessary and appropriate. The SNB remains ready to intervene in FX market as and when needed but the economy will be hurt if rates are increased now.

The US Session

- US Q1 GDP – The GDP report was pretty impressive at first glance as the US economy grew by 3.2% in the first quarter beating expectations of 2.2% by a full point. Personal consumption increased by 1.2% in Q1 against 1.0% expected. Business investment grew by 2.7%, home investment declined by 2.8%. Inventories come at +$128.4 billion, adding 0.65% to the GDP. Exports increased by 3.7%, while imports declined by 3.7% in the first three months. Consumer spending on durables came at -5.3% against +3.6% prior.

- US Advance GDP Price Index Q1 – The GDP price index came at +0.9% against +1.2% expected and 1.7% previously. Core price index at +1.3% against 1.4% expected (Q4 of 2018 was 1.8%). GDP deflator came at +0.6% against +1.3% expected. The USD jumped 20 pips higher initially on the headline GDP number which was strong but it has reversed and is now 10 pips down from the starting level. Nice jump in the GDP but inventories, which are the highest since 2015, and personal consumption helped GDP jump higher. Net trade also added added 1.03% to the GDP which is the largest in six years. Trade and inventories are temporary factors, which should reverse in Q2, hence the reverse in the USD. Inflation was weaker than expected as well and it is also weighing on the USD.

- Trump Speaking – US President Donald Trump was speaking just now, saying that trade talks with China are going very well. China is helping US with North Korea and he also appreciated statements made by Putin about North Korea. He also said that he called OPEC and told them to bring prices down. But not Iran, I suppose.

- Revised UoM Consumer Sentiment – The first reading for the consumer sentiment stood at 96.9 points and was expected to be revised a tick higher to 97.0 points today, But it was revised higher to 97.2 points while the final reading for March now stands at 98.4 points.

- Revised UoM Inflation Expectations – Inflation expectations have been declining from around 3.0% in summer last year to 2.4% in March. There are no expectations for this indicator but it ticked higher to 2.5% which is a good sign after declining for a year.

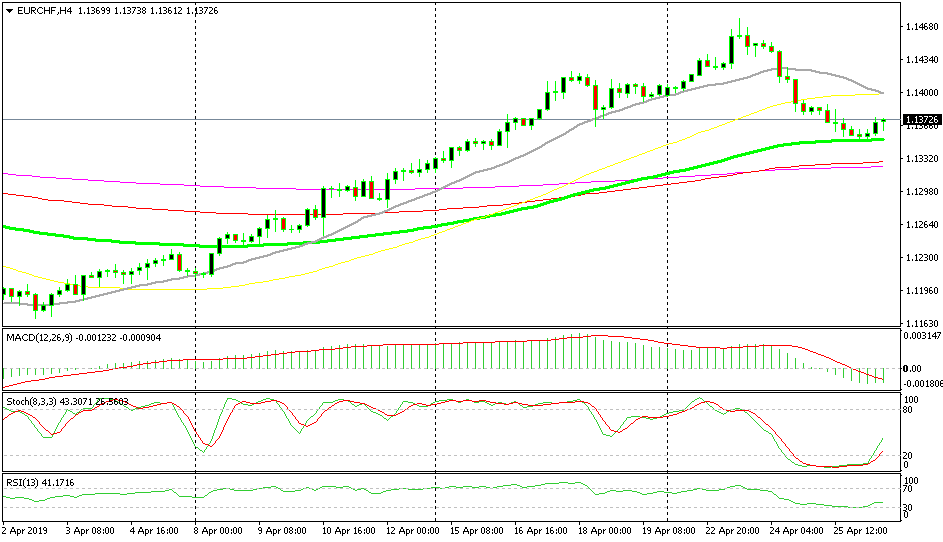

Bullish EUR/CHF

- The trend has been bullish all month

- The pullback down is complete

- The 100 SMA has turned into support

The 200 SMA has turned into support for Bitcoin now

EUR/CHF has been on a bullish trend all this month after the SNB threatened with intervention at the beginning of April. Since then, this pair has climbed more than 300 pips and the 20 SMA (grey) has been providing support during this time. But it was broken this week as EUR/CHF retraced lower and the retrace seems complete now. The price also found support at the 100 SMA (green) on the H4 time-frame chart and is bouncing higher off it.

In Conclusion

The US GDP report that everyone was waiting for is now out and it was impressive as it showed a 3.2% expansion in the economy in Q1 this year. The USD jumped initially but the details weren’t too promising as the buildup in inventories and the increase in trade are temporary factors likely to turn lower in Q2 which would hurt the GDP in this quarter. So, the USD has turned slightly bearish now.