WTI Oil Prices Surges Amid Middle East Tensions – Technical Outlook

At the beginning of a new week, oil prices rose in Asia as tension remains high between Iran and the United States. The US Crude Oil WTI Futures are trading 0.43% higher at $57.84. The US President Donald Trump announced that the US would impose extreme sanctions against Iran this week after Tehran’s Islamic revolutionary guard crops said it shot down the US RQ-4A Global Hawk surveillance drone.

Besides, Iran blamed the United States for attack and spying over Iranian airspace, while the US said that the aircraft was in international airspace when it was targeted. The United States is likely to inflict sanctions on Iran that would be announced today, during the US session.

How This Impact Crude Oil?

The clashes between the United States and Iran are likely to support oil prices as investors will be waiting to see Iran’s response to the threat of additional sanctions.

Crude oil is also supported as OPEC is likely to extend output cuts in its meeting. OPEC members are concerned about oil prices, and they are most likely to discuss the extension of the production cut tomorrow on Tuesday.

WTI Crude Oil – Technical Outlook

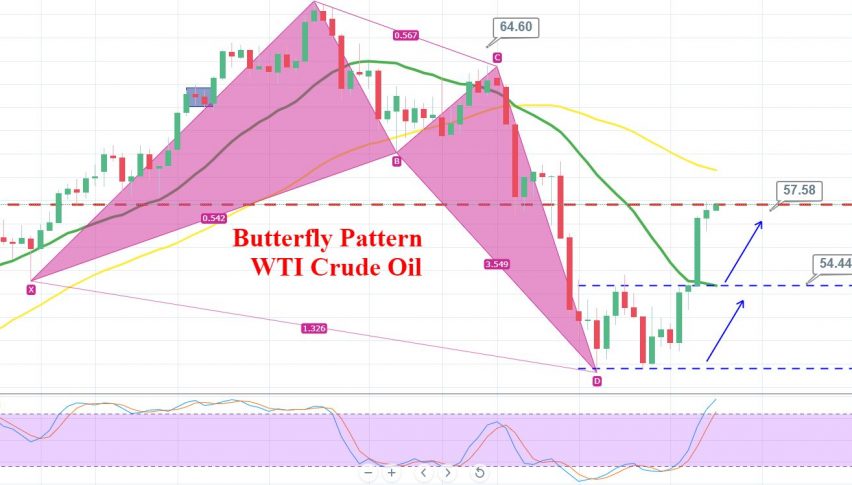

Technically, crude oil continues to be supported after it closed a bullish butterfly pattern on the daily timeframe.

At the moment, US Oil is staying right below the support cum resistance level of 57.85. The bullish breakout of this level may extend the buying trend until 59.40 and 61.

In between 59.40 and 61, crude oil is likely to face 50 periods EMA which may keep oil lower. Stochastics and RSI are heading north, suggesting bullish bias among traders.

Support Resistance

56.84 58.16

56.09 58.73

54.77 60.06

Key Trading Level: 57.41

The idea is to stay bullish above 57.40 with an initial target of 59.40. Elsewhere, selling is suggested below 57.35 today.

Good luck!