Buying GBP/USD, As UK Services Surge on Receding Omicron

The GBP has been showing increasing bearish pressure since the beginning of this year, after the bearish reversal in the second half of 2021. GBP/USD turned bearish in June last year as the FED adjusted its rhetoric according to the surging inflation, which continues to increase. This forex pair lost more than 10 cents, as it fell from above 1.42 to 1.32 until December. Since then though, the pressure has turned to the upside.

EUR/USD also made a strong bullish move earlier this month, but it has been unable to sustain it, while the GBP is still trying to push higher. Bank of England has turned hawkish as inflation increases in the UK as well and has hiked interest rates twice already, which has been helping the case for GBP bulls.

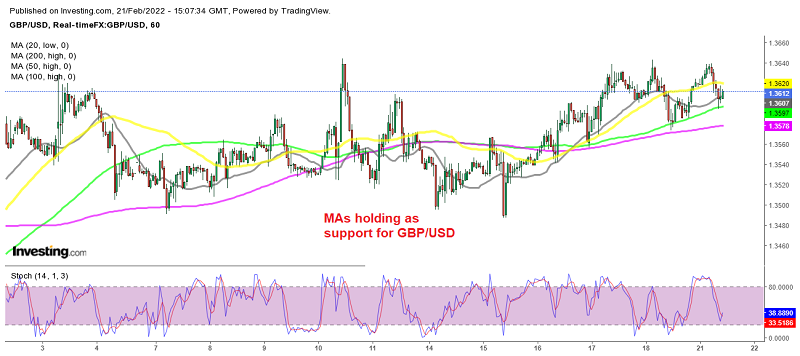

Although, coronavirus was still weighing on the sentiment since the UK has had some strong measures. But the new omicron variant has shown to be pretty weak, displaying that the coronavirus is weakening and the pandemic is coming to an end. UK government has removed the measures which is another positive factor for the GBP, which has helped the service sector. The activity in this sector surged in February which should help keep the GBP bullish. We decided to open a buy forex signal in GBP/USD above the 100 SMA (green) on the h1 chart, after the retreat.

GBP/USD Live Chart

UK Services Report by Markit/CIPS – 21 February 2022

- February flash services PMI 60.8 points vs 55.2 expected

- January services 54.1 points

- Manufacturing PMI 57.3 points vs 57.5 expected

- January manufacturing was 57.3 points

- Composite PMI 60.2 points

- Prior composite 54.2 points

That’s the fastest growth in economic activity in eight months as the services sector rebounds strongly as the omicron impact proves short-lived. The jump is helped by a strong recovery in consumer spending on travel, leisure, and entertainment. That said, price pressures remain an issue with input cost inflation accelerating again in February – coming close to breaching the survey-record high in November last year. Markit notes that:

“The latest PMI surveys indicate a resurgent economy in February, as business activity leaped as COVID-19 containment measures were relaxed.”